Fund Commentaries

1Q 2021 Commentary

Summary

- During the 1st Quarter 2021, the RVC Emerging Asia Fund returned +17% versus the MSCI SEA which was -1%.

- Over the past 12 months the Fund returned +118% versus the MSCI SEA which was +30%.

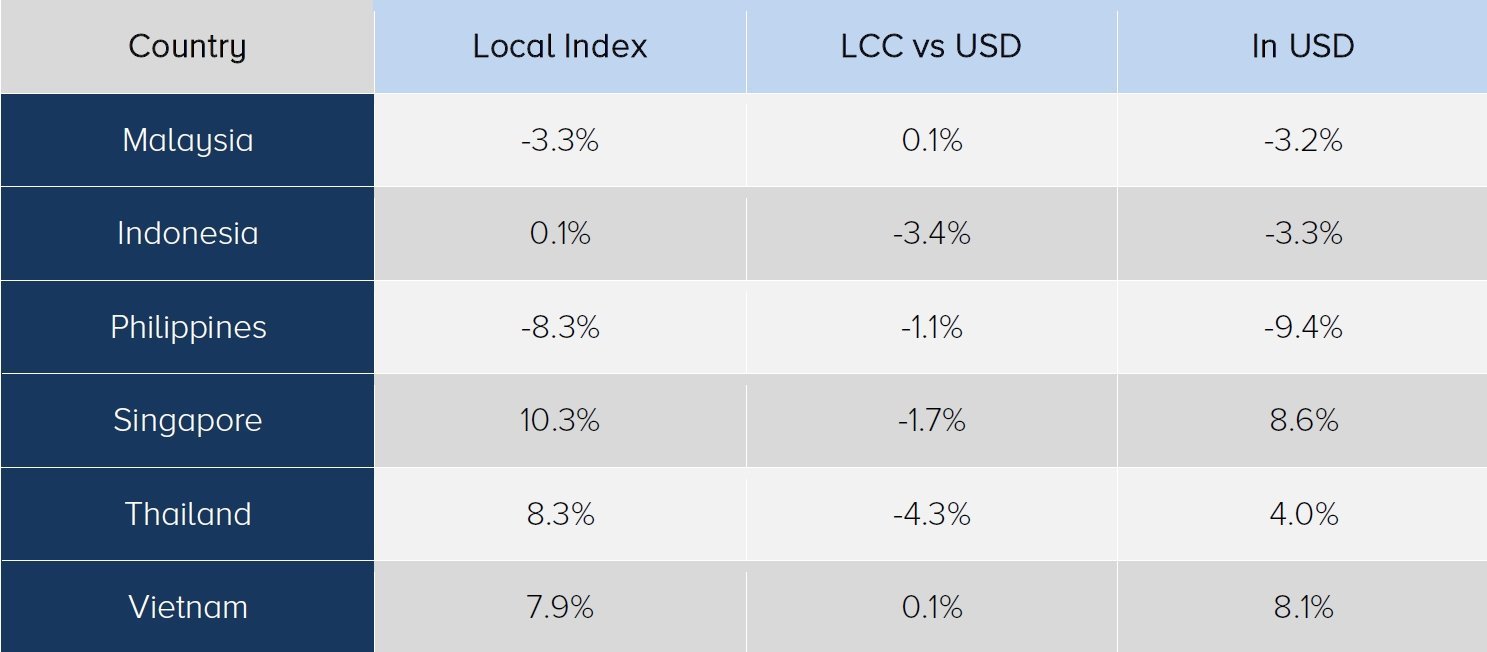

ASEAN Equity Markets 1Q21 Performance

Commentary

The vessel stuck in the middle of the Suez Canal is analogous to the world today. Economies and businesses are generally stuck in a wait and see mode for recovery, each trying to survive, expand or pivot towards new industries.

In the 4Q20 Commentary we highlighted that our holdings were positioned in the following themes:

- Supply Chain Disruption 14%

- Market Share Consolidation 15%

- Business & Travel Recovery 39%

- Vietnam Ascent 10%

- Bad Debt/Non-bank financing 17%

These themes continued into the 1st Quarter of 2021, with the weightings in these themes at:

- Supply Chain Disruption 15%

- Market Share Consolidation 10%

- Business & Travel Recovery 30%

- Bad Debt/Non-bank financing 22%

- Vietnam Ascent 7%

- Thai Hemp 5%

Movements

There have been multiple adjustments in weightings during the 1Q21 due to the strong performance of names. Cash in the Fund increased to its highest level in 12 months at ~6%.

The key movements of note were:

- Supply Chain Disruption - Within the supply chain theme we were active in the shipping names whose weightings had increased to ~10% during the quarter, these were subsequently reduced as the share prices were ~+40-50% during the quarter. Similarly with oil-commodity related, one holding, PTTEP in Thailand, was fully exited as oil prices had increased rapidly.

- Business & Travel Recovery - As news of the vaccine rollout within the region accelerated, several hotel/tourism related companies share prices increased rapidly. As we view the rollout in the region to be a messy process, this was an opportune period to exit and trim several positions such as Erawan Hotel Group (ERW). This period was not one purely of trimming or exiting positions, Indonesia has been far more successful than other countries (excl Singapore) in vaccinations, we initiated a new position in Ramayana Lestari Sentosa, a well known retail department store in the country.

- Vietnam Ascent - Both of our banking names had performed very strongly in this quarter (+40-70%), as a result of this we halved the weightings of one the positions, VP Bank as it grew to ~6% of the Fund.

What is Thai Hemp?

The Thai Government announced the legalisation of cannabis and hemp related businesses and products. There are over 30 companies in the country that have mentioned in one form or another that they will be involved in the industry. The industry potential is massive, but it is at very early stages and licenses/concessions are given to those friendly with the government. We noted the market potential and initiated positions in multiple names throughout the industry value chain that are supported by their core businesses and where hemp/cannabis products/services will be additional revenue streams only. These group of holdings have performed +10-50% within a short amount of time and we shall manage the positions accordingly.