Fund Commentaries

1Q 2022 Commentary

Summary

- Performance

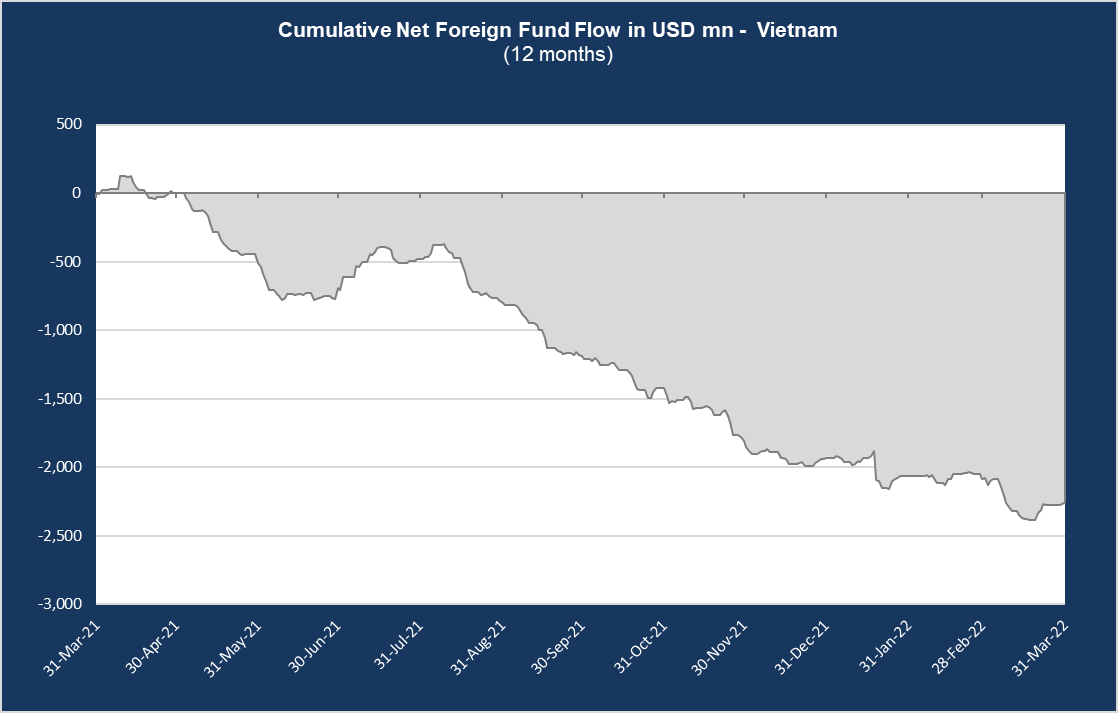

- Increased exposure to Vietnam, dry bulk and commodities

- Capital flows into Indonesian and Thai equities of USD 6 bn for 1Q2022

Performance

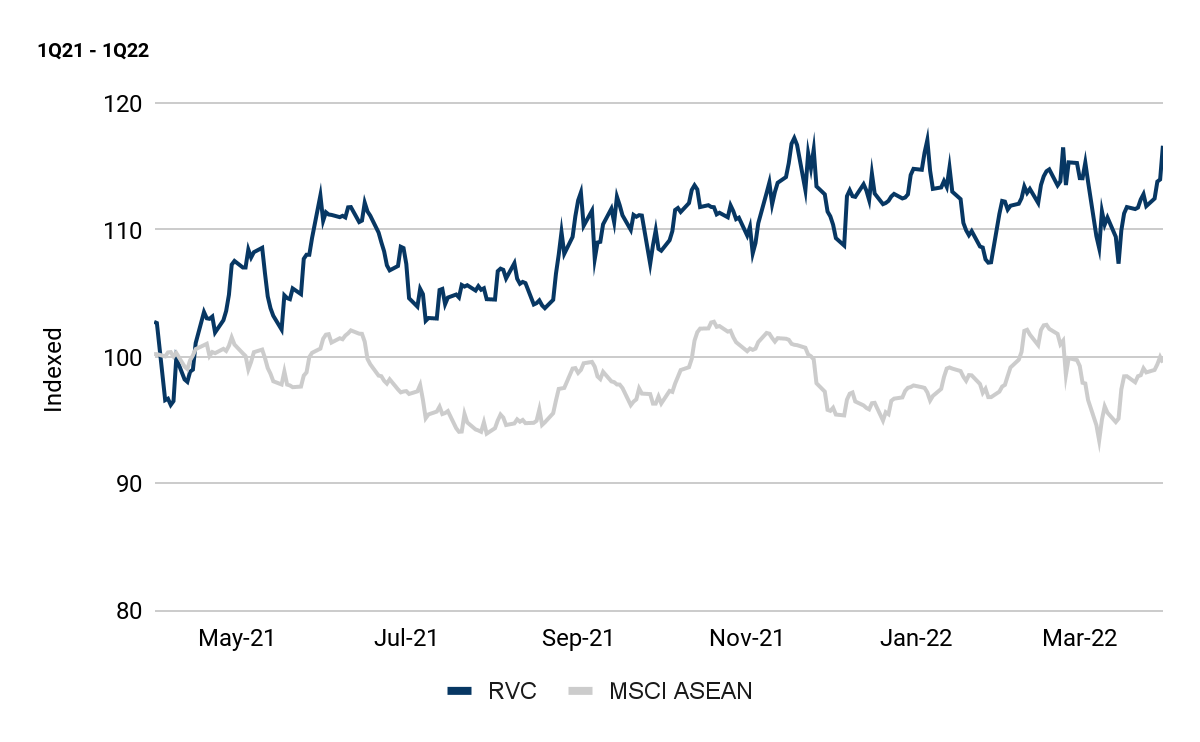

In the first quarter of 2022, the RVC Emerging Asia Fund returned +1.6% versus the MSCI ASEAN which increased +1.8%.

Over the past 12 months the RVC Emerging Asia Fund returned +16.5% versus the MSCI ASEAN which declined -0.5%.

Key Movements & Weightings

Key Movements

The Fund was active in January quickly increasing cash from near 0% intra-month to 10%, as a result of the movements in the market due to Omicron and other factors which resulted in opportunities again being available and thus:

- In the month of January we increased our exposure to ITMG IJ

- Increased weightings in tourism related plays in Thailand, specifically CENTEL TB

- Increased our weightings in Vietnam with the majority in GMD VN which is now 5% of the Fund.

- Increased exposure to dry bulk during Chinese New Year.

- As a result of the Ukraine/Russia war, we took advantage of the spike in oil prices to USD 130/bbl and reduced one of our oil holdings, specifically PTTEP TB from 3% to 1% of the Fund.

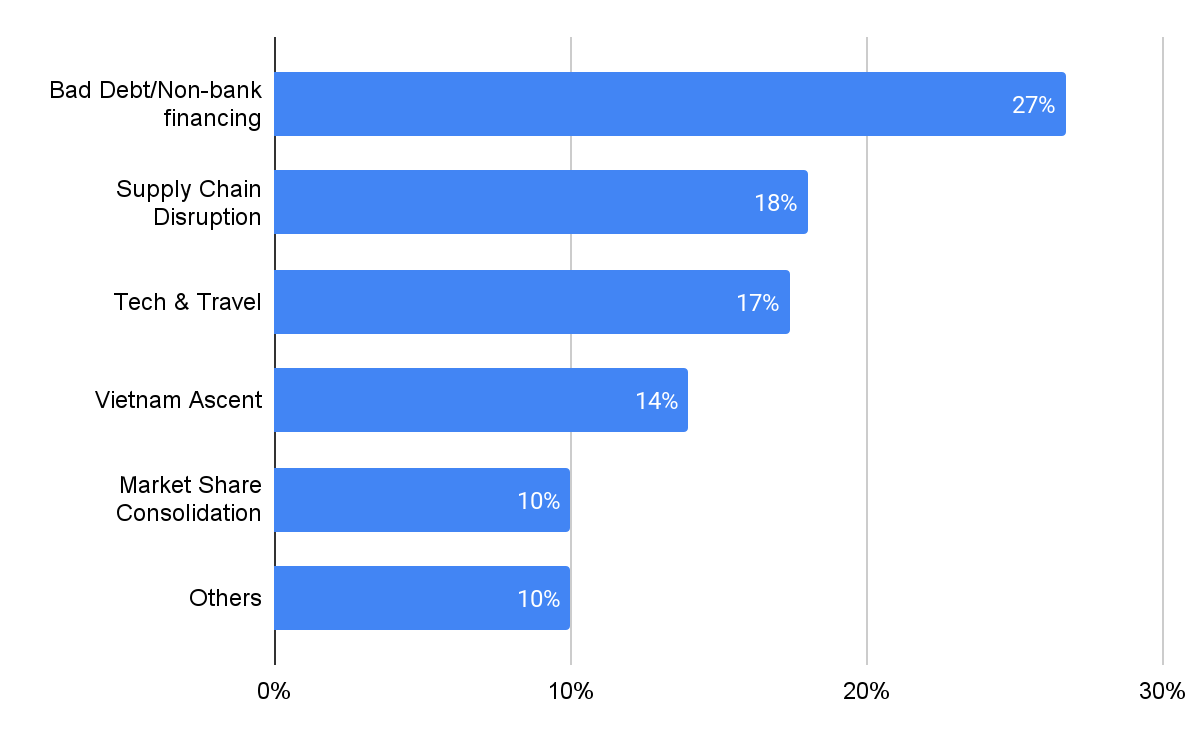

Weightings by Category

| % Weight | Key Name(s) | |

|---|---|---|

| Bad debt/Non-bank Financing | 27% | JMART TB, SINGER TB, JMT TB, CHAYO TB |

| Supply Chain Disruption | 18% | ITMG IJ, PSL TB, TTA TB, HIBI MK, III TB |

| Tech & Travel | 17% | CENTEL TB, SHR TB, MAC PM, BE8 TB, YGG TB |

| Vietnam Ascent | 14% | GMD VN, VPB VN, TCB VN, SCS VN, VTP VN |

| Market Share Consol | 10% | RALS IJ, MRSGI PM, SEVN PM, JFC PM |

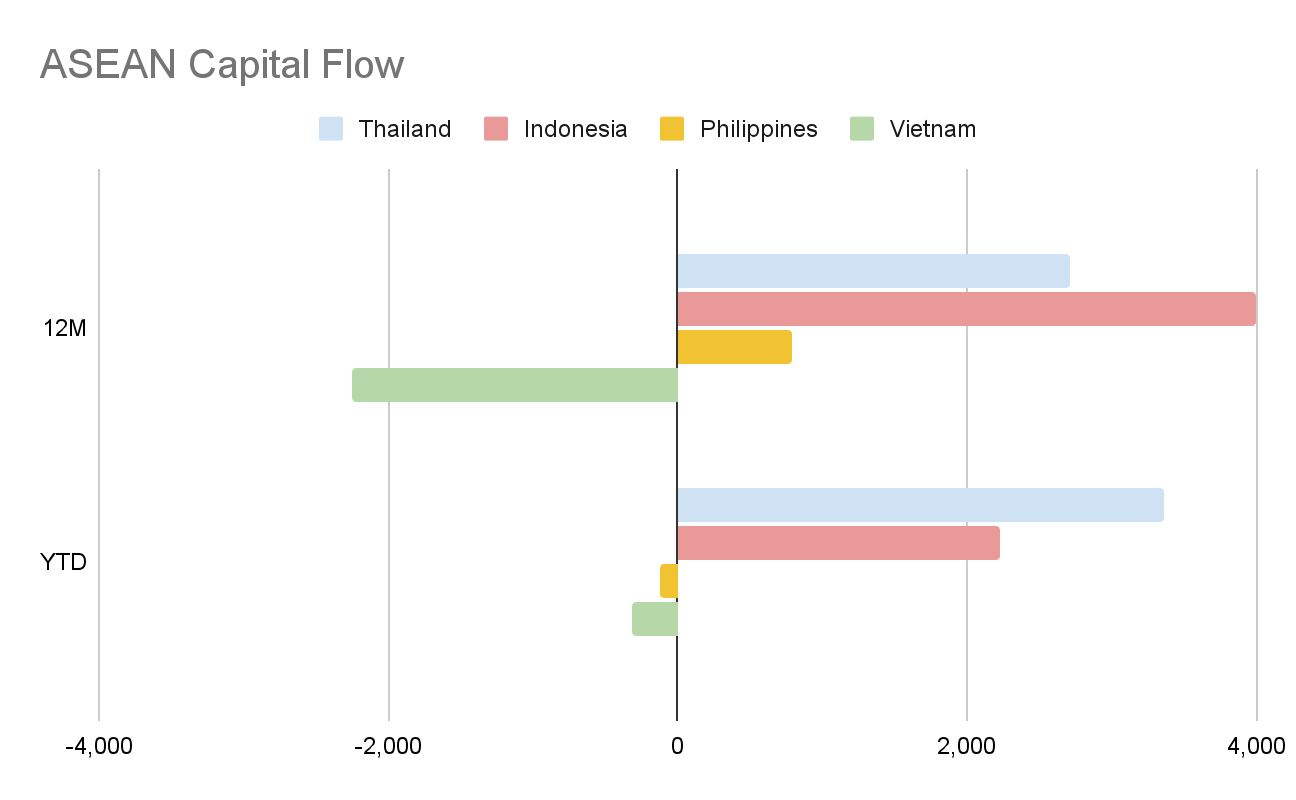

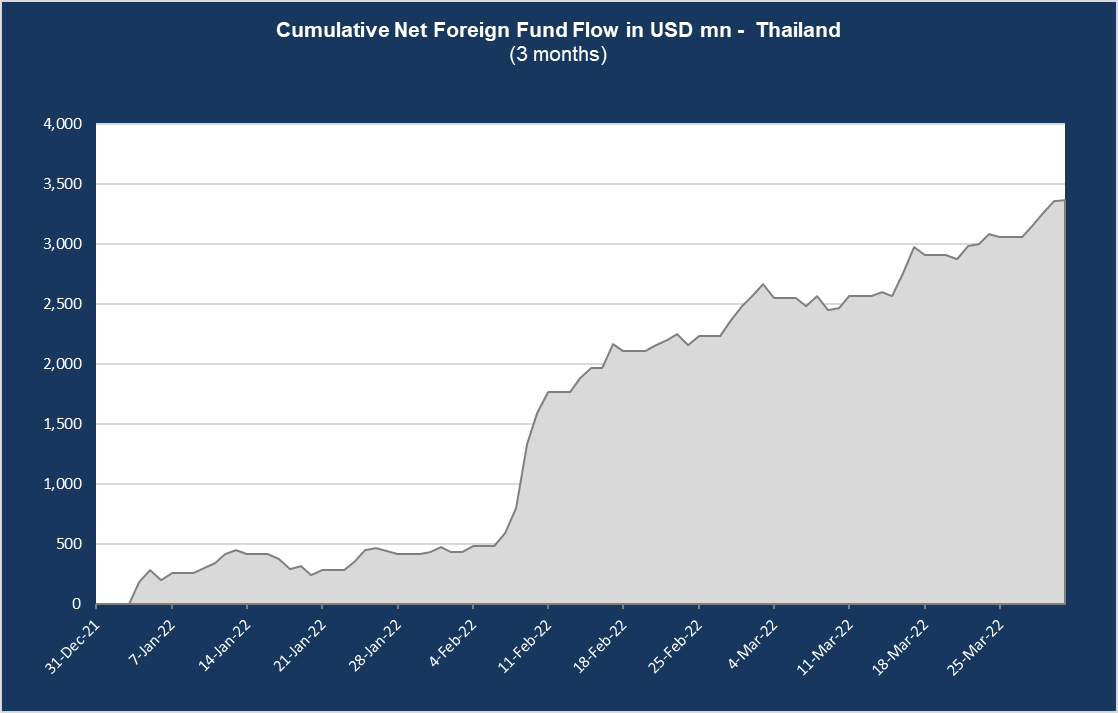

Capital Flow ASEAN

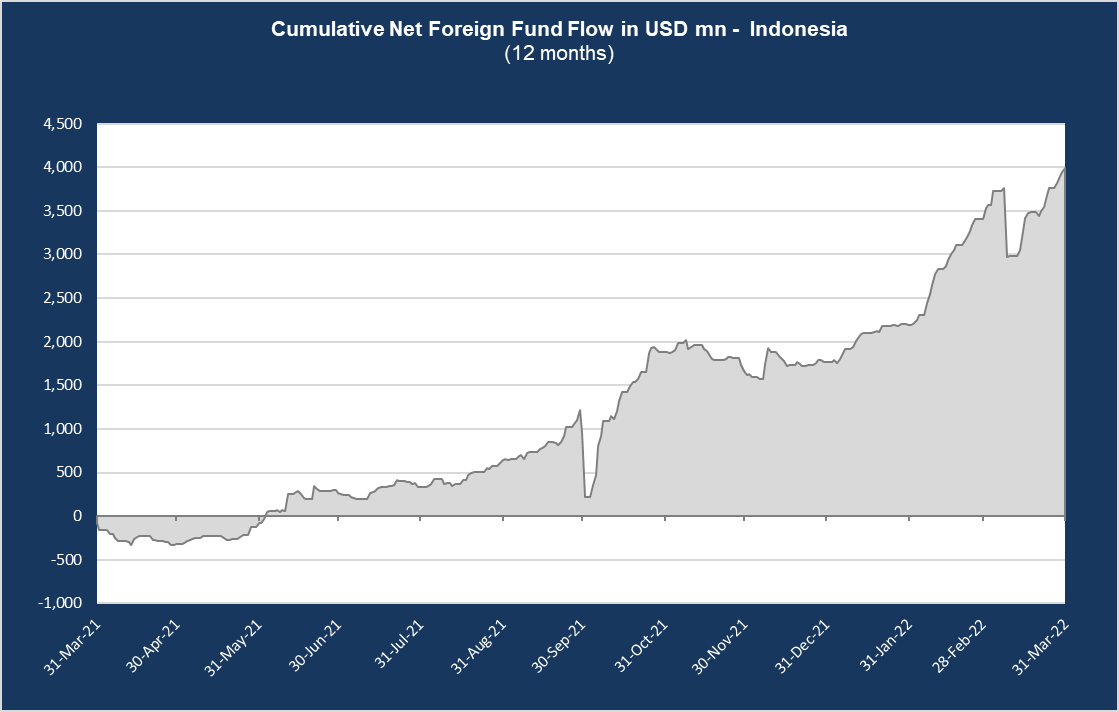

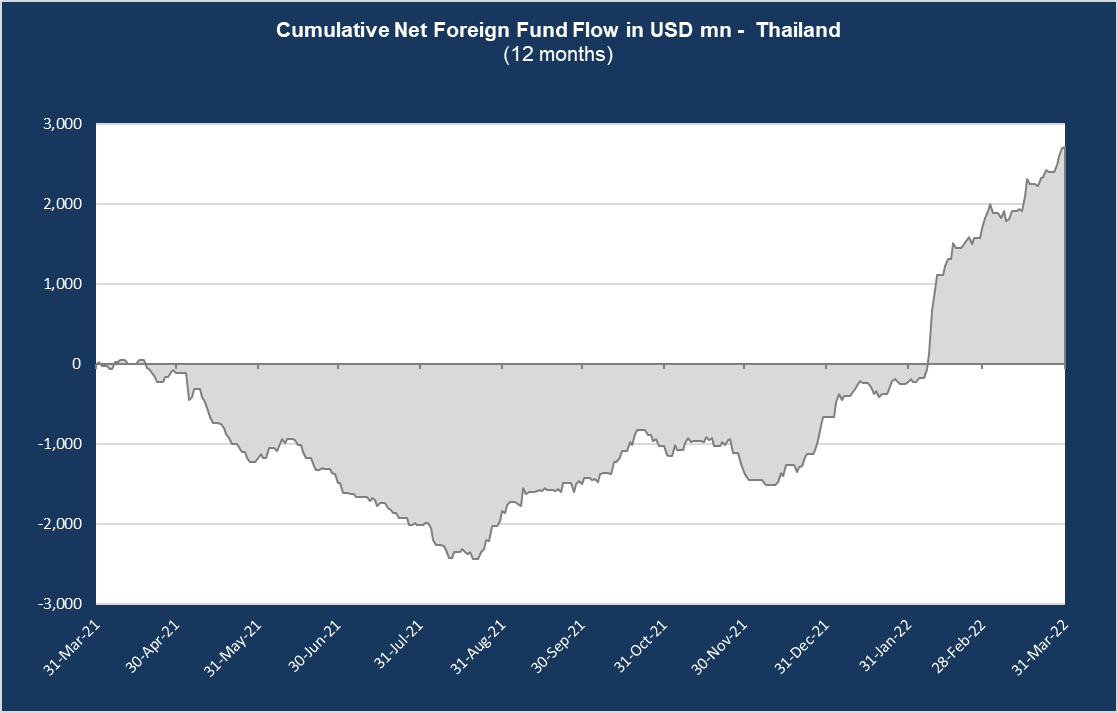

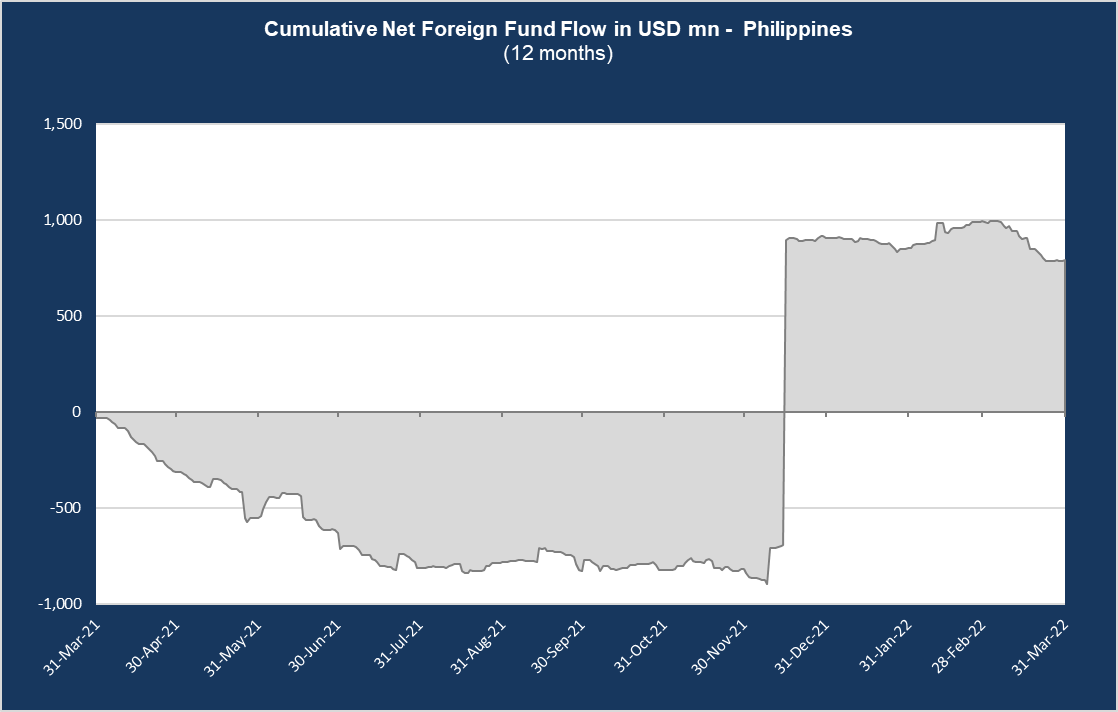

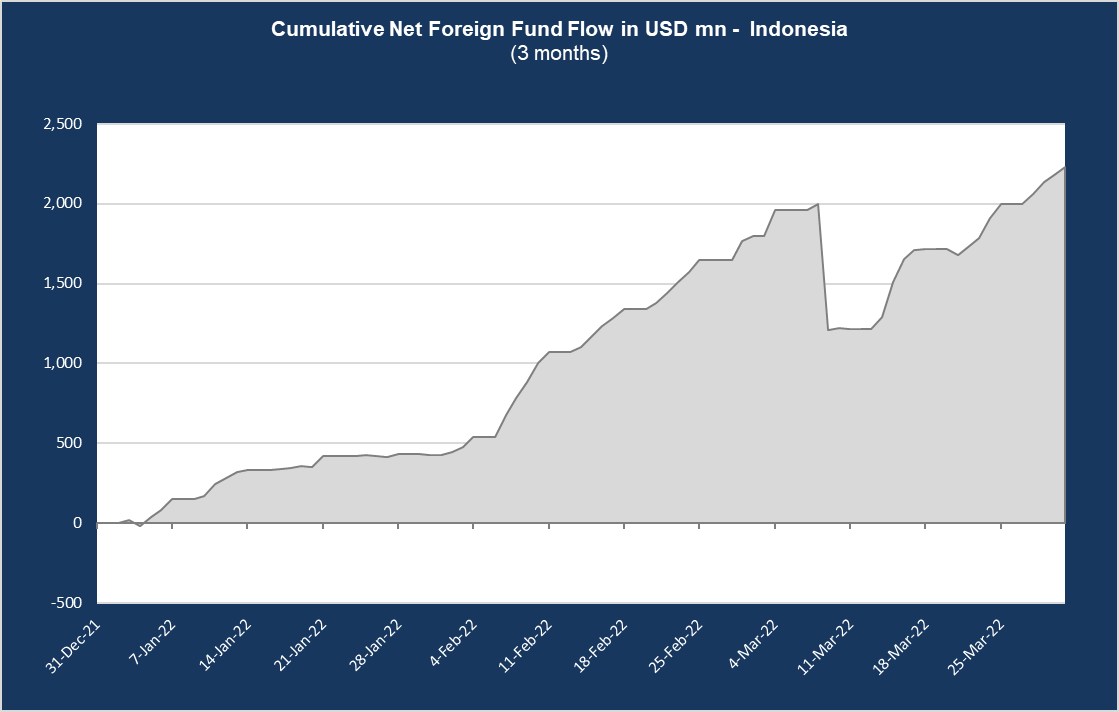

During the First Quarter of 2022 there has been a shift in international capital flow into ASEAN, specifically to Indonesia and Thailand.

Summary:

- Over the past 12 months, $3.9 bn into Indonesia, $2.7 bn into Thailand

- Year to date, $2.2 bn into Indonesia, $3.4 bn into Thailand.

3 months

12 months