Fund Commentaries

2Q 2022 Commentary

Summary

- Performance

- Increased exposure to Vietnam, dry bulk and commodities

- King dollar

Performance

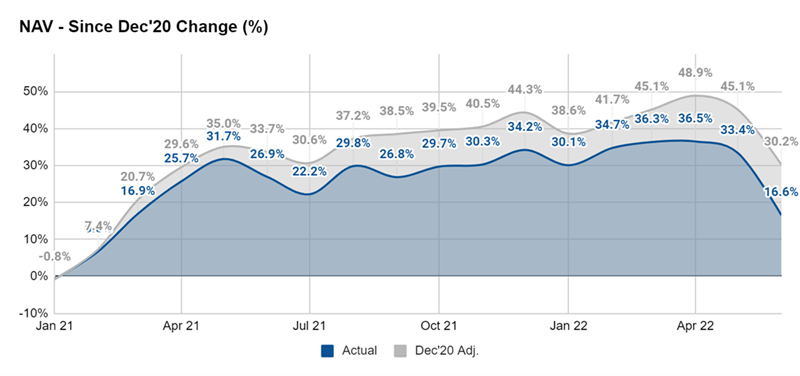

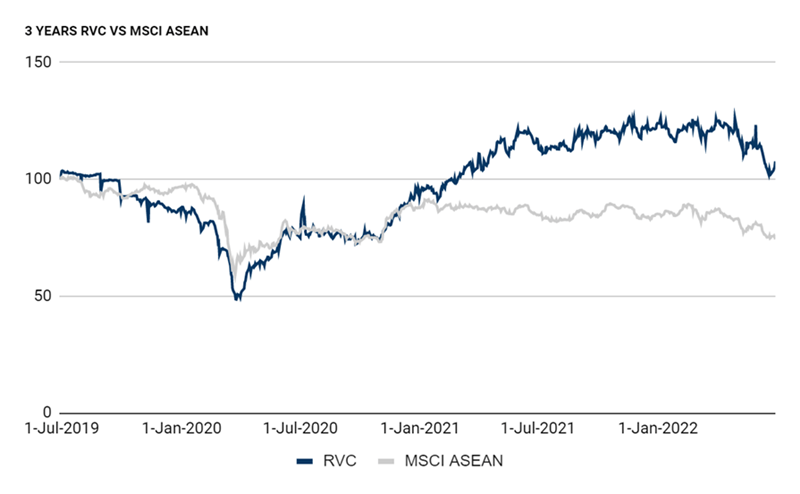

Over the past three years, the RVC Emerging Asia Fund returned +7.70%, versus the MSCI ASEAN which declined -25.68%

Over the past 12 months the RVC Emerging Asia Fund returned -8.15% versus the MSCI ASEAN which declined -12.36%.

In the second quarter of 2022, the RVC Emerging Asia Fund returned -14.50% versus the MSCI ASEAN which declined -14.37%.

Key Movements & Weightings

Key Movements

The Fund was active during the second quarter of 2022, as a result of the movement in the markets due to currency fluctuations, fears over interest rate hikes and multiple other factors. The regional markets offered attractive opportunities, specifically in Vietnam’s capital markets, and thus the key movements during the quarter were as follows:

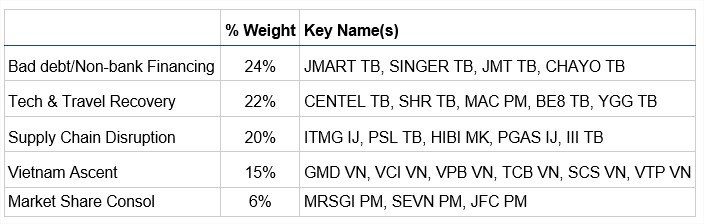

- Increased the country weighting in Vietnam to 15% of the Fund. The Vietnam stock market had declined close to -30% for the year and therefore presented multiple opportunities. Specifically, we further increased the weighting in GMD VN, increased our position in VCI VN, Vietnam’s leading capital markets firm for foreign institutions, from 0.5% to ~3%, initiated a position in VCB VN, the leading SOE financial institution with a 2% weighting and increased weightings in our remaining holdings in Vietnam.

- Fully exited SILO IJ (3%) due to the share price reacting positively to a stock split news announcement, combined with our viewpoint that the major shareholder, Lippo, is acquiring additional shares in the company thereby substantially reducing the free float. This corporate action may prevent the shares from realising its fair value within a respectable time frame.

- Fully exited from RALS IJ as we became worried about the governance of the company due to their lack of communication with investors on a clear strategic plan to recover. Instead we initiated and increased positions in both PWON IJ and MAPA IJ, companies which both are going to benefit from the increasing earnings power and spending by the mid-high income earners in Indonesia.

- Reduced exposure to dry bulk shipping due to share price appreciation.

- For our oil & gas related names, we reduced exposure in HIBI MK at the beginning of the quarter from 4% to 2.5% as the share price appreciated strongly by nearly +50% for the year, and towards the end of the quarter as the share price declined by -35% from our exit price, we increased our exposure. Further we increased our weighting in PTTEP TB and initiated a new position in PGAS IJ, a gas distributor in Indonesia.

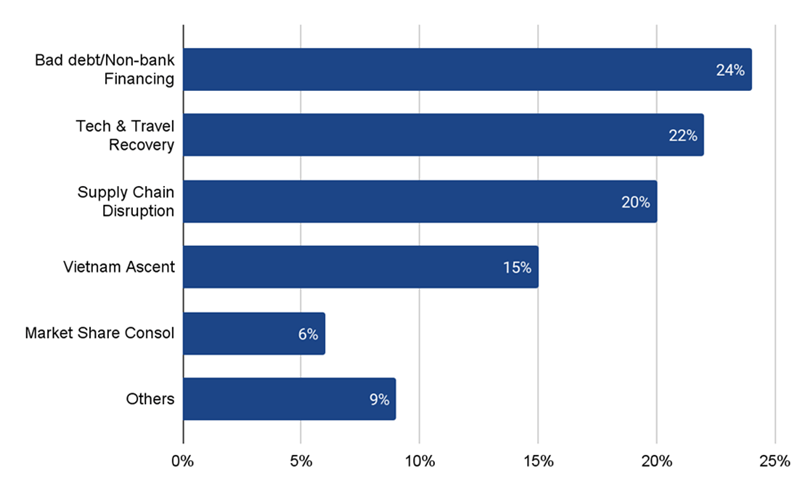

Weightings by Category

KING DOLLAR

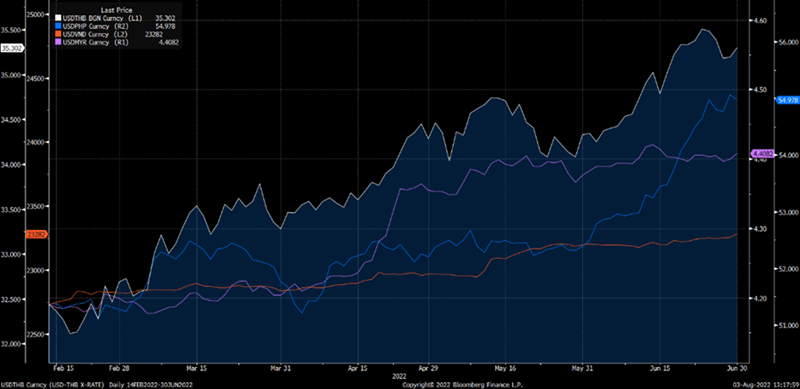

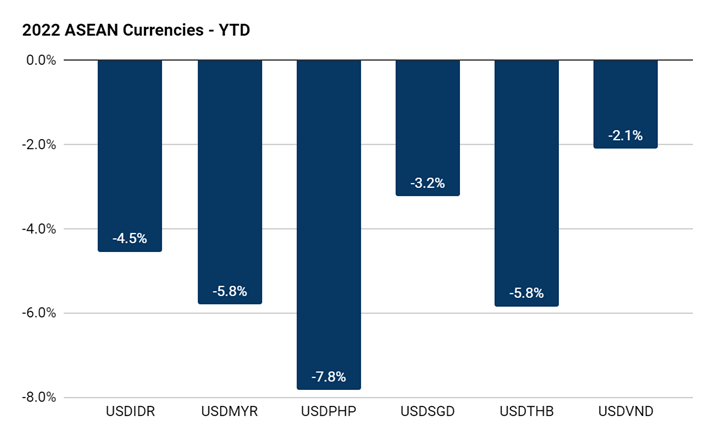

During the second quarter of 2022, the King Dollar roared, thereby negatively impacting our performance. As can be seen the strongest declines were seen in both the Thai Baht and the Filipino Peso. Even the Malaysian Ringgit and the Indonesian Rupiah, both commodity exporting economies, saw their currencies weakened. As with other periods of historical dollar strengthening we are of the opinion that going forward from the third quarter 2022, that we expect to see ASEAN currencies recover strongly.

As of the end of June 2022, the weakest performing currencies are the Malaysian Ringgit, Philippine Peso and the Thai Baht.

Since the end of December 2020, we estimate that currency weakness has negatively affected the Funds returns by -14%.