Fund Commentaries

1Q 2023 Commentary

1st Quarter 2023

Summary

- Performance

- Key Movements & Weightings

Performance

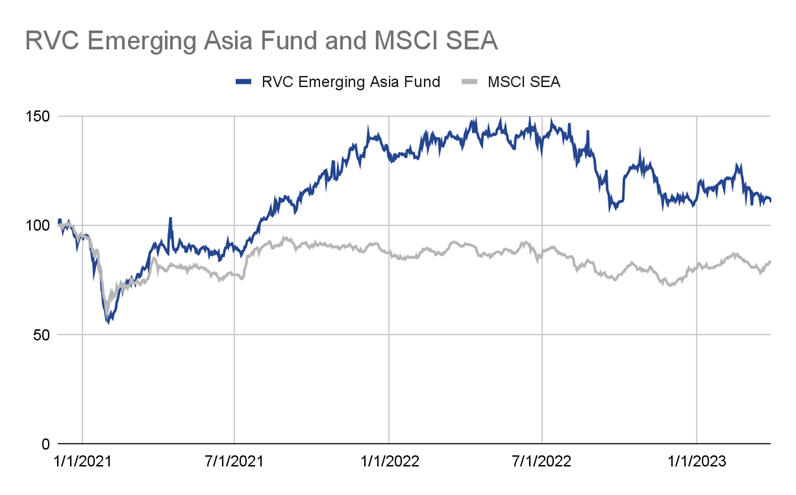

Over the past three years, the RVC Emerging Asia Fund returned +91.7%, versus the MSCI ASEAN which increased +20.8%.

In the first quarter of 2023, the RVC Emerging Asia Fund returned -4.3% versus the MSCI ASEAN which increased +1.9%.

Over the past 12 months the RVC Emerging Asia Fund returned -24.6% versus the MSCI ASEAN which declined -7.5%.

Key Movements & Weightings

Key Movements

The Fund was active during the first quarter of 2023. Markets began on a positive note due to China’s reopening announcement followed by the continued reality of higher interest rates affecting asset prices. The key movements during the quarter were as follows:

Jaymart Group (JMART TB) & Singer Thailand (SINGER TB)

Both of these names were positions held since 2019 at 3-4% weightings in the Fund, during the covid-era we trimmed the holdings in shares by 80% as the prices of both companies increased by 3-4x. At the beginning of 2023 due to weak earnings, specifically in SINGER, we fully exited this holding and due to the decline in the JMART’s share price, we took advantage of the price decline and increased the weighting of JMART from ~1% to 3%.

GT Capital (GTCAP PM)

As the Philippines was the last country out of full lockdowns in 2022, the earnings for listed companies there are likely to be incredibly positive in 2023. As a result of this we initiated a position of 3% in GT Capital (GTCAP PM) and 3% in D&L Industries (DNL PM).

GTCAP is a Filipino conglomerate and is the holding company for the Ty family’s stake in Metrobank (MBT), Toyota Motors Philippines (TMP), Metro Pacific and Federal Land. Its FY22 earnings, PHP 16bn, have already surpassed FY19 level. TMP, of which GTCAP owns 51%, reported that 2M23 car sales have increased by +27% YoY to 28,299. At the end of 2019, the shares were trading at PHP870/share, today it is at PHP500/share, trading at 6x trailing earnings, 0.5x of book value, and at a discount of 45% to its NAV.

D&L Industries (DNL PM)

DNL is an R&D-based manufacturing company that customises, develops and produces chemical components for food ingredients, personal and home care use, raw materials for plastics and aerosol products. They are a market leader in its categories and exports its high-margin products to Asia, US and Europe. At the end of 2019, their shares were trading at PHP 15/share, today its PHP 8/share and reported their highest profit earnings for FY22. By mid 2023 the company will be opening a new manufacturing facility that will increase capacity by 2x for its high margin products. We foresee in the next 3 years as the new facility ramps up that exports will increase from 30% to near 50%, and their high margin business will increase from 50% of revenue to at least 70% thereby driving profitability and margins. Currently it’s trading at 15x trailing earnings with an ROE of 16%.

Commodity/supply chain related

We were active regarding our commodity related positions. At the beginning of 1Q23 we fully exited ITMG IJ (4%), an Indonesian coal producer, as the spot price of coal was decreasing rapidly from its peak of $400/tonne to $160/tonne, note that at the end of 2019 coal was trading at $60/tonnes, recognising profits of 2x. We also fully exited PTTEP TB during the same period as we were worried about the potential short term decline in oil prices.

During the month of February, we increased the weighting of PSL TB from 2% to 6%. PSL TB is a position we held since 2019 as we expected that supply of new dry bulks would be below the increase in demand, and had sold 80% of the shares during the peak periods seen in 2021. We expect a recovery in shipping rates post Chinese New Years and the re-opening of China from their lockdowns. Since, the dry bulk shipping rates have doubled from their lows and are likely to continue increasing until the third quarter.

In the last week of the quarter, we re-initiated a position in PTTEP TB (1.5%), a new holding in BCP TB (1.5%) and MEDC IJ (4.5%), increased our weighting in HIBI MK from 4% to 6%, and VEB MK from 3% to 5%, and exited PGAS IJ (2%) to fund these positions. Our timing proved fortuitous as OPEC and friends announced production cuts for oil on the first weekend of April 2023.

Medco Energi Internasional (MEDC IJ)

MEDC is an integrated energy company involved in oil and gas exploration and production (E&P) activities in Indonesia and overseas. Beside its E&P operations, MEDC also runs a power plant business under Medco Power Indonesia (MPI), and greenfield gold and copper mining assets under Amman Mineral (AMNT). The company is trading at 4x trailing earnings, and benefits from the high commodity price environment for oil, copper and gold, AMNT’s potential IPO as well as positive contributions from its 2022 acquisition of Corridor.

Velesto Energy (VEB MK)

Velesto Energy is a Malaysian operator of jack-up rigs for drilling of oil & gas. It operates primarily in offshore Malaysia for clients such as Malaysia’s national oil company Petronas and oil majors such as ExxonMobil. The company currently owns six relatively modern jack-up rigs (“JUs”) as well as four hydraulic workover units (“HWUs”) used to monitor existing oil & gas wells, stabilise structure and improve productivity. Similar to the drybulk thesis in 2019, the jack-up rig industry has had close to a decade of underinvestment due to overcapacity in the early 2010s and more recently a lack of bank funding for the industry due to ESG requirements. A decade ago JU rigs were commanding rates up to $400,000-500,000/day, during the 3Q2022 JU rig rates declined to its low of USD 60,000, today they are commanding $120-135k depending upon the category. With Petronas announcing its 2023-2025 budget indicating higher capex requiring 25 and 28 rigs of which it’s half and half between JUs and HWUs, VEB MK is incredibly well positioned to benefit from the increasing demand trend. The shares are currently trading at 0.5x book value, and we began initiating the position during 4Q22.

Indonesia

In a nutshell, Indonesia as an economy has benefitted and will continue to benefit from this era of higher commodity prices as they are the periodic table of the region. The last period was during 2006-2012 which saw the Indonesia economy grow at high single digit growth rates despite the Global Financial Crisis in 2008-2009, and 20-30 million people joined the middle class. We have seen the performance of our holding, Map Aktif (MAPA IJ) since 2021 as the share price has doubled and earnings are above pre-covid levels demonstrating that the consumer is stronger than expected in Indonesia. During the quarter we began initiating positions in multiple companies in Indonesia, as we are still continuing to accumulate shares and aiming for attractive entry prices, we will provide additional information on the three new positions by the end of the 2Q23.

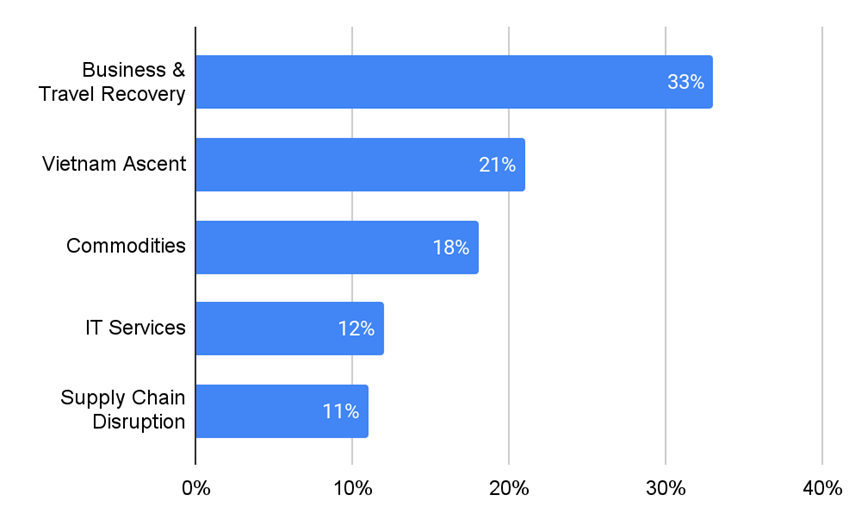

Weightings by Category

Top 5 weightings (accounting for 26% of the Fund)

- HIBI MK

- PSL TB

- GMD VN

- VEB MK

- MEDC IJ

Top Contributors during 1Q23

- Positive: VCI VN, GMD VN, VPB VN, VCB VN, MAPA IJ

- Negative: JMART TB, SINGER TB, JMT TB, DGW VN, PSL TB

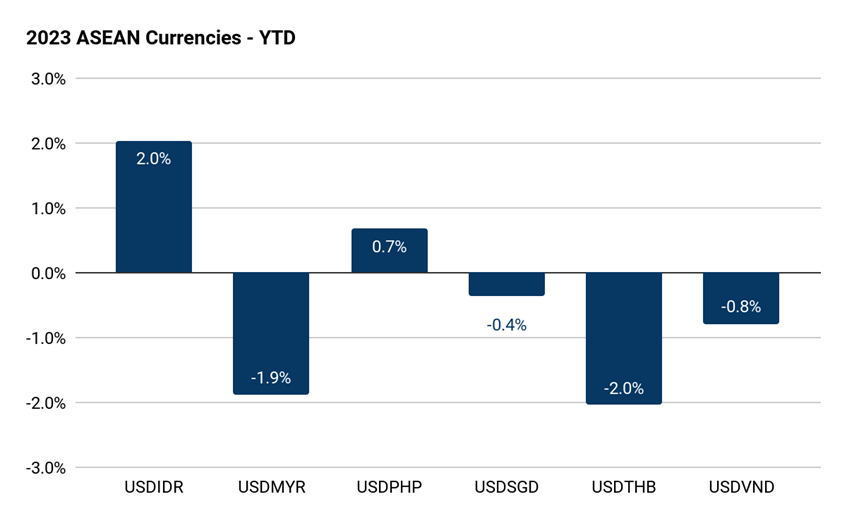

Currency

As of the end of March 2023, strongest performing currency is the Indonesian Rupiah, the weakest performing currencies are the Malaysian Ringgit and the Thai Baht.

Tickers mentioned

- GMD VN - Gemadept Corporation

- HIBI MK - Hibiscus Petroleum Berhad

- PTTEP TB - PTT Exploration and Production Public Company Limited

- VCB VN - Joint Stock Commercial Bank for Foreign Trade of Viet Nam (Vietcombank)

- VCI VN - Viet Capital Securities Joint Stock Company

- PSL TB - Precious Shipping PCL

- DNL PM - D&L Industries Inc

- GTCAP PM - GT Capital Holdings Inc

- VPB VN - Vietnam Prosperity Joint Stock Commercial Bank

- MEDC IJ - Medco Energi Internasional Tbk PT

- VEB MK - Velesto Energy Bhd

- BCP TB - Bangchak Corp PCL

- JMART TB - Jay Mart PCL

- JMT TB - JMT Network Services PCL

- PGAS IJ - Perusahaan Gas Negara Tbk PT