Fund Commentaries

2Q 2023 Commentary

2nd Quarter 2023

Summary

- Performance

- Country Thoughts

- Key Movements & Weightings

Performance

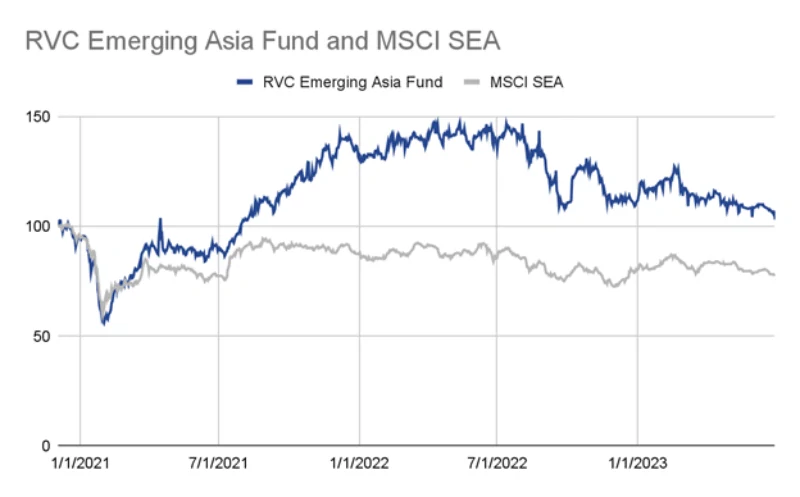

Over the past three years, the RVC Emerging Asia Fund returned +17.7%, versus the MSCI ASEAN which decreased -1.5%.

In the second quarter of 2023, the RVC Emerging Asia Fund returned -6.7% versus the MSCI ASEAN which decreased -6.0%.

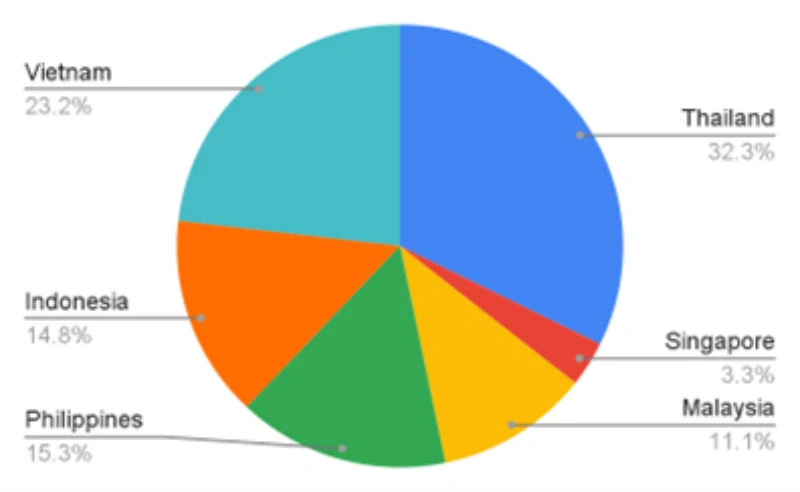

Country Thoughts & Weighting

Thailand

Thailand’s equity market has been pressured by both the scandal that unfolded with Stark Corporation Plc, a multi billion dollar market capitalization company that had accounting fraud resulting in -99% decline, and the continued (“constitutional") delay in the appointment of the Prime Minister. The juvenile nature of the country’s governance has weighed heavily on the performance of the domestic equity market as Thailand is amongst the worst performing equity markets in the world. However, we view that a government will be formed and that any government, not military led, signifies massive upside for the country. A simple example is when the military took over 9 years ago, the Prime Minister, Prayuth Chan-ocha, appointed himself as the Head of the Board of Investments (BOI), further, BOI meetings went from a monthly basis to a quarterly basis. Should a civilian government lead the country again we expect to see “normalcy” return to the civil institutions of the country and this would be a significant improvement for the overall economy.

Vietnam

We are positive on Vietnam’s stock market potential performance, however we are not overtly positive about the economic outlook for Vietnam. Despite all the positive news over the past few years that have noted Vietnam as an FDI economic powerhouse, the country simply does not have the power/energy capacity to sustain a 6-7% GDP growth rate for the foreseeable future. But in the short term, the stock market does not equal the economy.

During the second half of 2022 as the Vietnam Stock Market crashed due to 1) It was at high levels, 2) A corruption crackdown, 3) The liquidity crisis driven by the central bank actions. We took advantage of this to pick up attractive holdings, and continued to during 1H 2023 resulting in the country’s weighting increasing from 20% to 30% during 2Q23, mainly due to price appreciation.

Key Movements & Weightings

Key Movements

The key movements during the quarter were as follows:

Exits

Viet Capital Securities (VCI VN)

VCI VN is Vietnam’s leading institutional broker. During the 2H22 we accumulated a 4% position on the assumption that eventually both institutional and retail investors would become active again during 2023. This proved to be the case as liquidity in the market improved from USD 300 mn per day to near USD 900 mn thereby resulting in a share price increase of +50%, we fully exited the position.

Siam Wellness Group (SPA TB)

Siam Wellness Group Public Company Limited is a health spa and wellness-related businesses company based in Bangkok, Thailand. This was a covid-era holding as a play on the travel recovery. As the share price continued to rally and exceeded the pre-covid era price, and that it had achieved our target, we fully exited the position.

Existing holdings

Digiworld Corporation (DGW VN)

DGW VN is a leading technology distributor in Vietnam. The company has a strong distribution network and a wide range of products from phones, laptops to office equipment. One key aspect of DGW that we find attractive is that it is one of the rare companies in the country where the founders still hold a significant amount of equity. During 2Q23 we doubled the weighting to 5% as we expect a recovery in both electronic and industrial purchases throughout 2H23 and into 2024.

Mobile World Investment Corporation (MWG VN)

MWG VN is Vietnam’s largest retailer of consumer electronics and household appliances. During the boom periods of the Vietnam stock market this name used to command +40% premium for foreign shareholders above market prices. Thankfully during the crash and even during the quarter we doubled the weighting to 5% without paying a premium. The company has a strong track record of growth and profitability, and similar to DGW we expect to see a recovery in consumer purchasing in 2H23 and robust earnings growth from 2024 onwards.

New Holdings

Union Auction (AUCT TB)

AUCT TB is the leading auction house in Thailand for both cars and motorcycles. As the Bank of Thailand is no longer permitting Financial Institutions to hide their NPLs, over the coming years there will be a raft of vehicles that will need to be auctioned and AUCT TB is the prime beneficiary of this trend. After a tepid few years of performance with minimal growth, the 1Q23 of profits were close to ~40% for the Full year 2022, and thus we expect to see this year’s profits increase by +50% and for this trend to continue until 2025.

Delfi Limited (DELFI SP)

DELFI SP is one of the largest chocolate companies in Southeast Asia, with operations in Indonesia, the Philippines, and Vietnam. The company's brands include Delfi, SilverQueen, Goya, and Knick-Knacks. Delfi Limited produces a wide range of chocolate products, including bars, confectionery, and spreads. Trading at 10x net of cash on a forward basis, we began accumulating shares during 4Q22 and finished by the beginning of 2Q23 with a 4% weighting. A special thanks goes to AsianCenturyStocks for highlighting this name.

S Hotels & Resorts (SHR TB)

We re-initiated a position in SHR TB, for the third time, as the share price declined due to one of its hotels closing for renovation until the year end, to hold a 4% weighting. It owns a total of 38 hotels with a total of 4,552 keys in top destinations such as The Republic of Maldives, The Republic of Fiji, The Republic of Mauritius, The United Kingdom, and Thailand. We expect for the group to continue reporting impressive figures, and at 0.6x PBV is incredibly attractive.

Wattanapat Hospital Trang (WPH TB)

WPH TB is a hospital company based in Trang, Thailand, it was founded in 1982 and operates two hospitals in Trang Province: Wattanapat Hospital and Wattanapat Hospital Trang. The hospital group opened a third hospital on the island of Samui, effectively increasing its capacity by up to 50%. We took advantage of the share price decline during the quarter to accumulate a 5% weighting as we view it has multi-bagger potential.

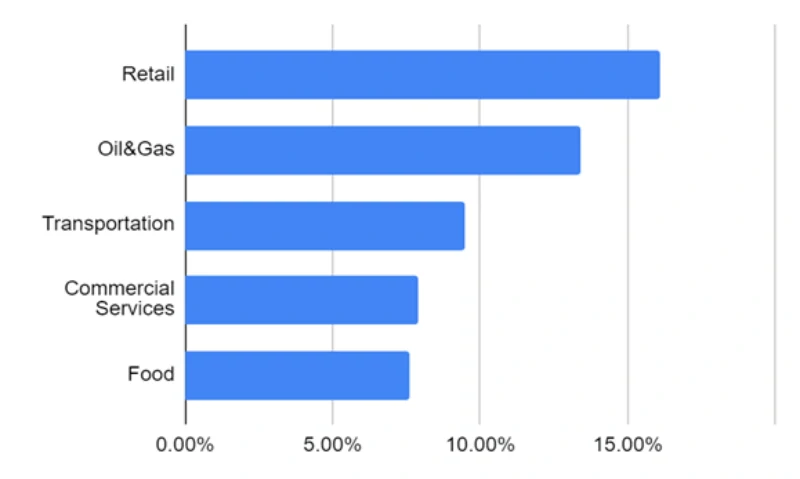

Weightings by Category

Top 5 Sector Weightings

Top 5 Positions (accounting for 26% of the Fund)

- GMD VN

- HIBI MK

- PSL TB

- VEB MK

- WPH TB

Top Contributors during 2Q23

- Positive: DELFI SP, DGW VN, MAPA IJ, MWG VN, VTP VN

- Negative: HIBI MK, IIG TB, JMART TB, JMT TB, PSL TB

Currency

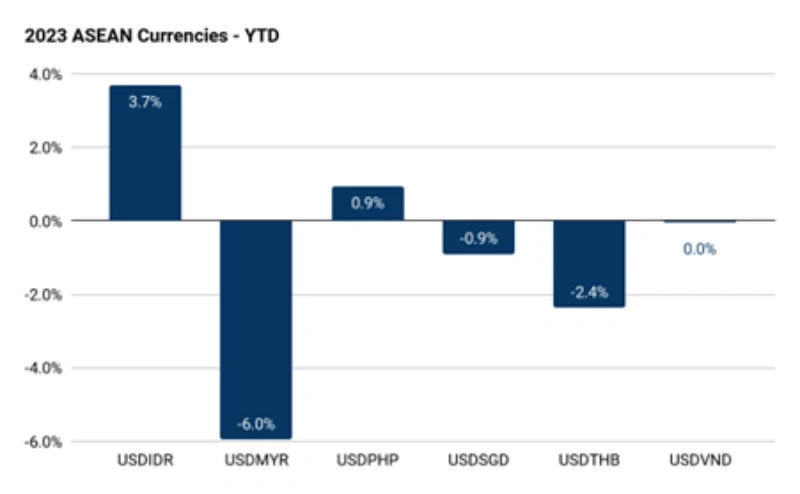

As of the end of June 2023, the strongest performing currency is the Indonesian Rupiah, the weakest performing currencies are the Malaysian Ringgit and the Thai Baht.

Tickers mentioned

- VCI VN - Viet Capital Securities Joint Stock Company

- SPA TB - Siam Wellness Group PCL

- DGW VN - Digiworld Corporation

- MWG VN - Mobile World Investment Corporation

- AUCT TB - Union Auction PCL

- DELFI SP - Delfi Limited

- SHR TB - S Hotels and Resorts PCL

- WPH TB - Wattanapat Hospital Trang PCL

- HIBI MK - Hibiscus Petroleum Berhad

- GMD VN - Gemadept Corporation

- VEB MK - Velesto Energy Berhad

- PSL TB - Precious Shipping PCL

- MAPA IJ - Map Aktif Adiperkasa PT

- VTP VN - Viettel Post Joint Stock Corporation

- IIG TB - I&I Group PCL

- JMART TB - Jay Mart PCL

- JMT TB - JMT Network Services PCL