Fund Commentaries

4Q 2023 Commentary

2023 Review

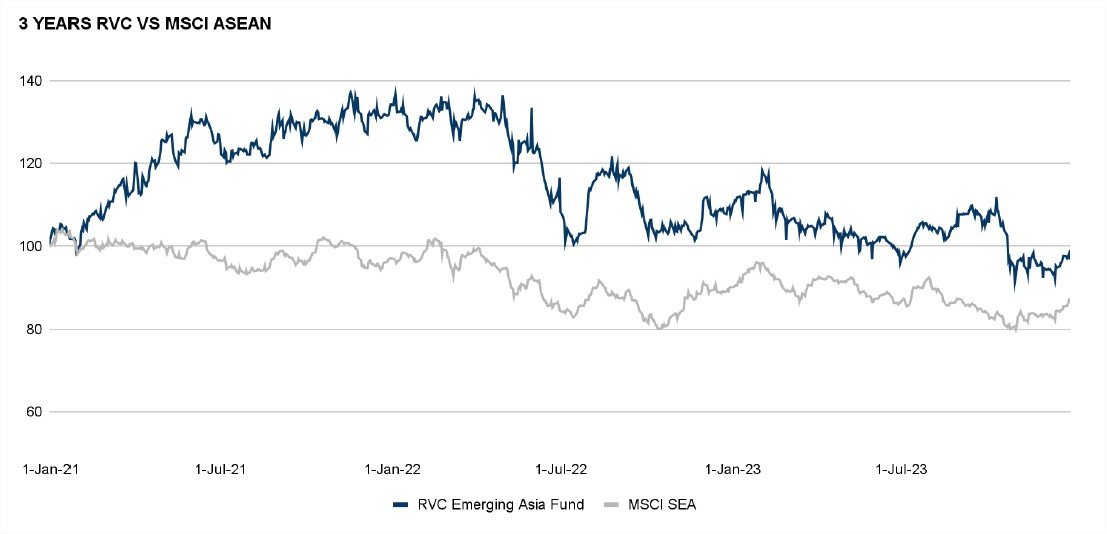

Over the past three years, the RVC Emerging Asia Fund (“Fund”) returned -3.3% versus the MSCI ASEAN -12.7%.

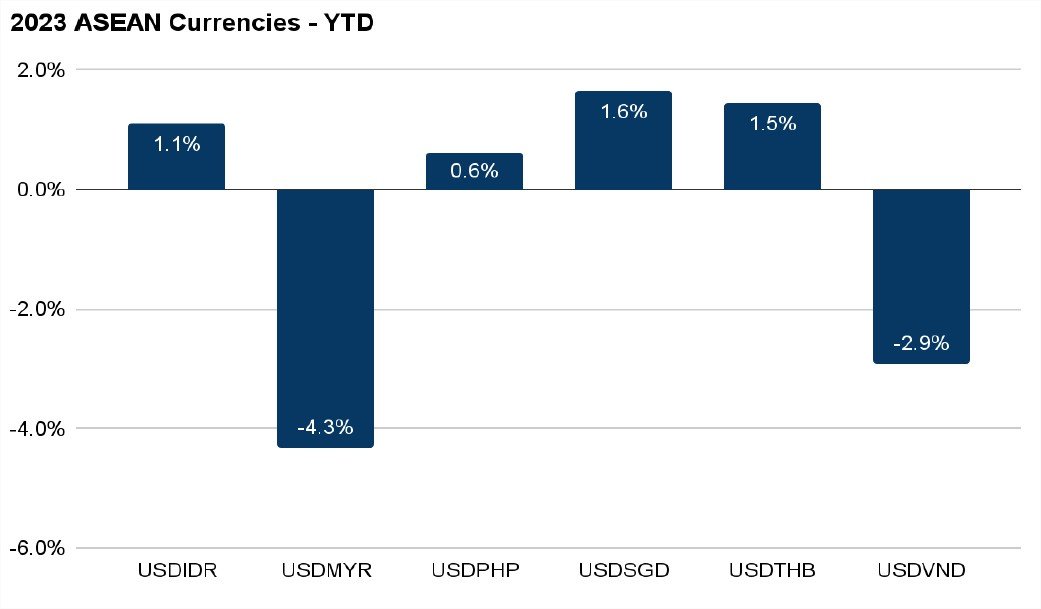

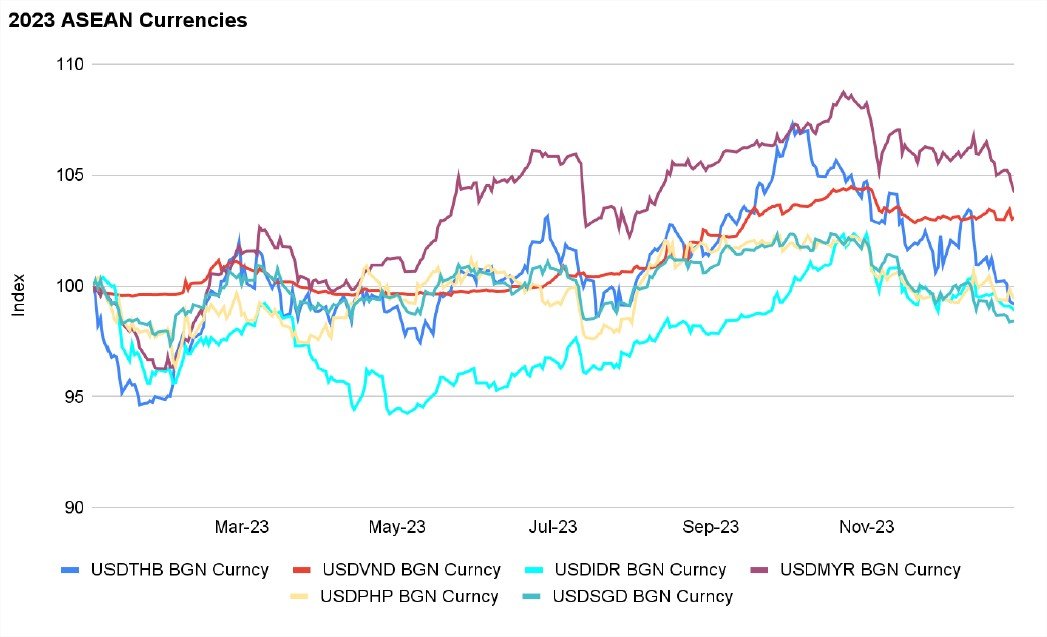

2023 continued to be a volatile year with continued global skirmishes, elections, a hard landing for the US economy which never happened, continued inflation, and currency volatility, as can be seen below with multiple currencies in the region such as the Thai Baht, Malaysia Ringgit,and Vietnamese Dong which were at one point during the calendar year -4% to -9% to the US Dollar.

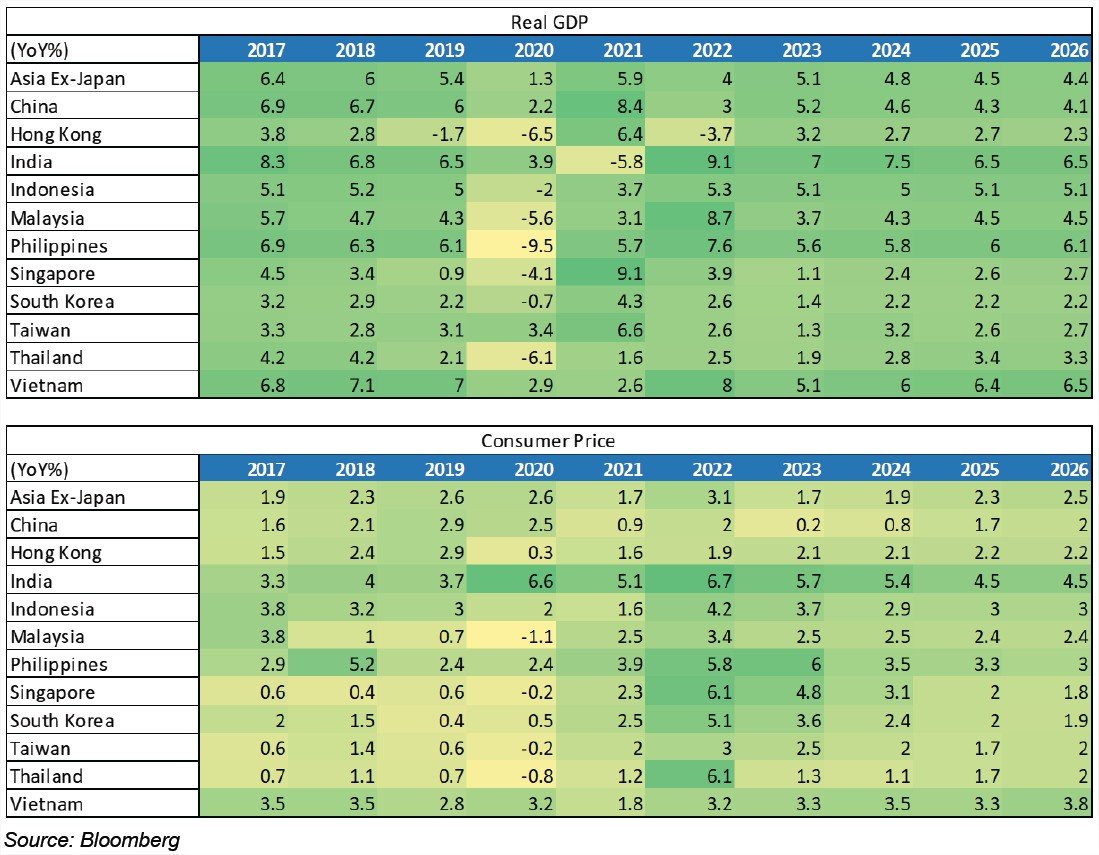

Despite this volatility, the economic performance and outlook for the ASEAN countries continued to remain stable and growth expectations for 2024 and onwards remain buoyant.

Portfolio Movements

We took advantage of the recovery in Vietnamese equities, decreasing our weighting there during the third quarter from 30% to 6% of the Fund. With these profits we allocated heavily into Indonesian equities, 30%, including SIDO IJ, ARNA IJ, ERAA IJ, and DELFI SP, that we expect will continue to benefit from the current Indonesian economic growth, improved infrastructure and the likely continuation in government policies.

Further we continued to expand our holdings in the oil & gas service providers (30% weighting), adding to the existing holding that is VEB MK, with additional service providers MPM SP, CSE SP and PVD VN. The thesis is straightforward, the oil&gas industry is one of the few industries that have and continue to earn strong cash flows and for the first time in a decade are investing in capacity expansions. The benefit for the service sector is that the majority of the competition have gone bankrupt over the past decade due to a lack of work, high debt etc. and the remaining players are able to secure long term project works resulting in their profit growths likely to increase 5x from 2022 to 2026.

Finally, going forward into 2024, with the focus on the oil & gas offshore services providers, Indonesia’s continued growth, Thailand’s continued tourism recovery and expansion of auxiliary tourism related businesses, and continually looking for opportunistic investments throughout the ASEAN region, we are looking forward to the performance of the Fund continuing to beat the region.

Thank you.

Tickers mentioned

- ARNA IJ - Arwana Citramulia

- CSE SP - CSE Global Ltd

- ERAA IJ - Erajaya Swasembada

- DELFI SP - Delfi Ltd

- MAPA IJ - Map Aktif Adiperkasa

- MPM SP - Marco Polo Marine Ltd

- PVD VN - PetroVietnam Drilling & Well Services JSC

- SIDO IJ - Industri Jamu Dan Farmasi Sido Muncul

- VEB MK - Velesto Energy Berhad