Musings

Shipping – An Awful Idea

The shipping industry is notorious for capital destruction with decades of underperformance followed by a few years of astounding rates. A key driver of the Fund's year to date performance of +12%, has been Precious Shipping Plc (PSL). A small mid cap (SMC) listed on the Thai stock exchange. We initiated the position in 2H19 and increased the weighting during January 2021. This year the share price has increased by +80%.

Chart 1: PSL share price performance

This name fits perfectly into our thesis of SMCs outperforming combined with supply chain issues which have been further exacerbated by Covid-19.

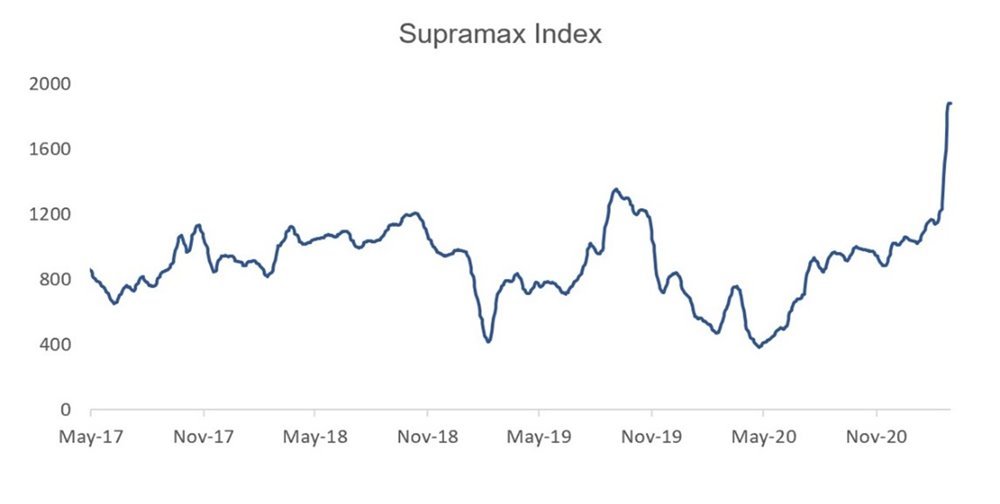

Chart 2: Supramax Index

We saw in 2019 that the advent of IMO2020 would lead to a demand and supply mismatch of ships in the dry-bulk segment. With 2020 seeing a drop in demand, several non-listed players removed supply from the market. Within the industry there has been significant issues with Covid quarantine restrictions, bottlenecks in ports and logistic lines, these issues further exacerbated the supply issue of IMO 2020. When combining the supply destruction with the subsequent recovery of demand over the past 6 months, the industry has seen rates in both the Supramax and Handysize ships increase to the highest levels not seen since 2010.

The question is can this continue? We believe so as supply will not catch up with demand for at least the next 2-3 years given the industry orderbooks. Further, there is a talk of the coming period being a new super cycle for the industry similar to what was seen in 2005-2008.

Charles De Trenck, Citi’s Asia Pacific research head during the last supercycle, and now an independent analyst and investor, has been flagging up the commodities rebound longer than most, since at least last September when he first started to clock key indicators flash green.

…

Commodities and shipping have been underinvested in for the last decade for economic and environmental reasons.

“On the demand side there is strong growth in commodities, in part driven by the snap back effect of economies beginning to reopen and restock, but also by the global fiscal climate, which is lax without parallel in history,” Du Cane says.

Splash Extra – 24/02/21

We have several SMCs in ASEAN such as PSL which are benefiting from the return of demand and limited

Should you wish to subscribe, please go to here