Musings

Non-Bank Financing Bad Debt

Asean Opportunities Everywhere

Continued policy errors and lockdowns in the ASEAN region and throughout multiple parts of the world allow for multiple opportunities to continue to arise.

Over the past 12 months we have written that the impact to the following industries is going to be strongly positive and the expansion of new investment opportunities are becoming clearer.

Bad Debt/Non-bank Financing:

- The supply of bad debt in Thailand’s financial system is 10-30x above AMCs annual purchasing capability providing high profitability for these equities for the next three to five years.

Supply Chain/Commodities:

- Imbalances will lead to four to five years of high shipping rates.

- Commodity related equities are paying high dividends ranging from 8-25%.

Vietnam

- Vietnam offers one of the strongest structural growth outlooks among developing markets led by industrialisation and urbanisation.

- 2022 GDP Growth Rates and FDI figures exceed every other country in the region by rate of change.

Market share/Recovery:

- The major companies in each industry are consolidating market share due to access to capital.

- Digital implementation and cost improvements will drive higher margins and returns on capital for the next two to three years.

This letter shall first focus on the Bad Debt/Non-bank Financing Industries.

Non bank financials/bad debt collection

The supply of Non Performing Loans (NPLs) and Non-Performing Assets (NPAs) in Thailand exceeds the bad debt companies' buying ability by 10-30x.

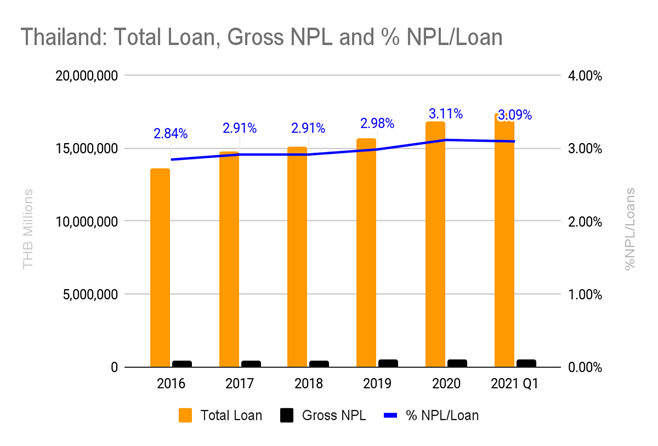

Source: Bank of Thailand

As with most countries globally, central banks and financial institutions have been generous to their borrowers with holiday payments, grace periods and so forth. Hence the official figures from the Bank of Thailand (BOT) show that Non-Performing Loans (NPLs) as of the 1st Quarter of 2021 were only 3.09% or THB 536 billion, an increase of THB 72 billion or +15% since the end of 2019 . Note that since 2016, NPLs in Thailand have increased anywhere from THB 20 to 50 billion per annum.

These moratorium policies from the BOT have hidden the true number of NPLs and NPAs in the system. BoTs Dr. Thitma’s wrote “The BoT has reviewed the impact of remedial fiscal and monetary measures launched last year with a priority to develop more targeted measures in 2021. Of the total soft loan package of THB 500 million, only 75,000 SMEs accessed a total amount of THB 130 billion, utilizing just 26% of the available funds, whilst the debt moratorium, which ended in October 2020, supported 11 million debtors with a total debt amount of THB 5.6 trillion.”

- That figure is ~33% of the total loans in the system for 2020.

- Today, we estimate that the combined annual value that asset management firms focused on NPLs and NPAs can purchase is ~THB 20bn.

- Today, the NPLs and NPAs being sold in the market are from the pre-covid period.

- What if only 3%, THB 160 bn, of those supported loans became NPLs/NPAs?

This setup provides a clear opportunity for our selected equities to perform incredibly well.