Musings

Supply Chain Commodities

Asean Opportunities Everywhere

Continuing the ASEAN opportunities series.

Today’s letter focuses on Supply Chains & Commodities.

Supply chain / Commodities

By locking down the world, the initial impact was the collapse of demand, what leaders misunderstood is that this leads to a decline in productivity thereby leading to a destruction of supply. As the world continues to reopen in staggered form, the positive rate of change of demand exceeds that of supply which results in drastic positive movements in supply chain and commodity prices.

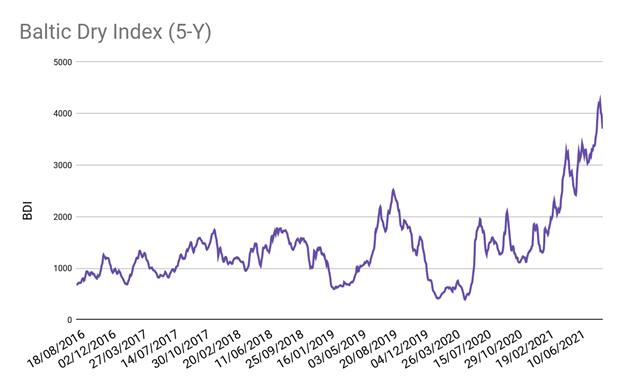

Our investments into dry bulk shipping names beginning in the 4th Quarter of 2019 were a function of IMO2020 which implemented new environmental regulations which should lead to supply being reduced by -10 to -15% in the industry. This supply shock combined with additional environmental regulations expected to be announced and shipbuilding yards now at full utilization for container ships implies that new supply of dry bulk ships will not be in the market for another four to five years.

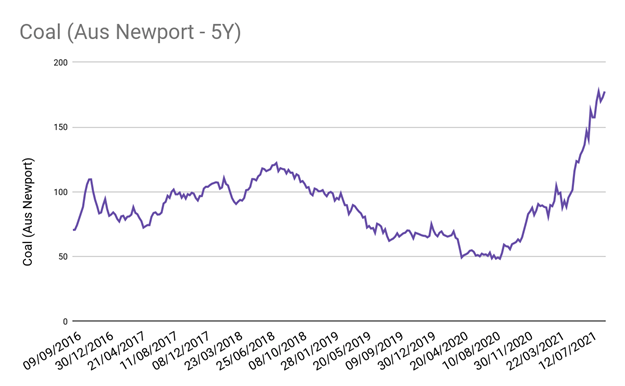

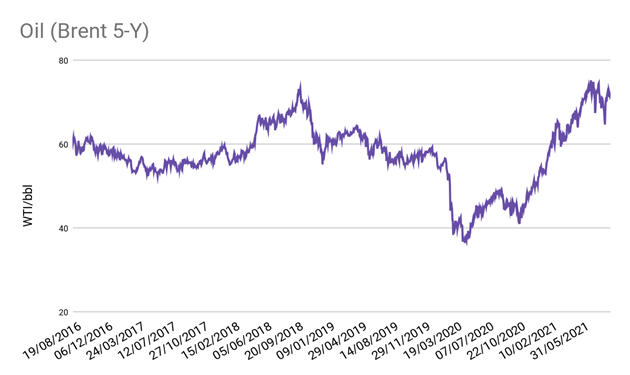

The price of energy now is far higher than the prices pre-lockdown, despite the planet being locked down. This is evidenced by multiple commodities including the below prices of both Coal and Oil.

There are multiple drivers for this whether it be the lockdowns, fiscal plans announced by governments globally to the tune of USD 20 trillion or the advent of Carbon-Neutral, Environmental, Social & Governance (ESG) public and private investment mandates. The expansion capital for much needed commodities will be in short supply thereby leading to dislocations in capital markets.

As the global economy continues to reopen, the rate of change in the increase of demand will be far higher than supply, this is evidenced by OPEC increasing their demand forecasts for 2022 to be higher than 2019.

Today our holdings in oil and gas companies in Thailand and Malaysia will be paying dividends in high single digits in 2022 and cash-rich Indonesian Coal Miners are paying dividends north of 20%.