Musings

Market Share & Recovery

Asean Opportunities Everywhere

Continuing the ASEAN opportunities series.

First paper: Non-Bank Financing / Bad Debt

Second paper: Supply Chain / Commodities

Third paper: Vietnam

Today’s final letter focuses on Market Share & Recovery.

Market Share/Recovery

- The major companies in each industry are consolidating market share due to access to capital.

- Digital implementation and cost improvements will drive higher margins and returns on capital for the next two to three years.

Market Share

Excluding Singapore, the governments’ assistance towards businesses and individuals in ASEAN has been lacklustre, if not, non-existent when compared to the US and Western Europe.

A simple example we use is that your favourite boutique/independent hotel or restaurant shall remain open. But the second, third or fourth on your list will most likely have shut down permanently. That boutique/independent entity which survived will eventually see an increase in demand and be able to charge higher prices than the pre-covid period due to reduced competition. As for the locations that have closed, this real estate will either be left empty or acquired/re-leased to a chain hotel or restaurant group. The result of this environment is that market share will naturally go to the larger groups in each industry.

In our analysis, the definition of large is simply publicly listed companies. Public companies have access to capital that private companies and SME’s do not have access to at the same cost of capital or at all. Regionally, bank lending requirements have tightened to an extent that further exacerbates the economic situation in all countries in the region.

The Philippines as a country is one dominated by large conglomerates, it’s the perfect example of a market of companies that will maintain and grow market share as their non-listed peers simply cannot compete. Thailand is a second one, in the hospitality industry where companies such as Centara Plaza Hotel Group and S Hotel & Resorts went into the Covid-19 era with net cash balance sheets and are levering up acquiring competitors or planning to.

The past 18 months has also seen companies reduce their fixed and variable costs whether that is through negotiations with suppliers and landlords, reduction in the workforce, and/or the implementation of digital services to streamline operations. We view this as an opportunity for listed companies over the coming years to produce higher operating margins leading to higher returns on capital and therefore being able to command higher valuations.

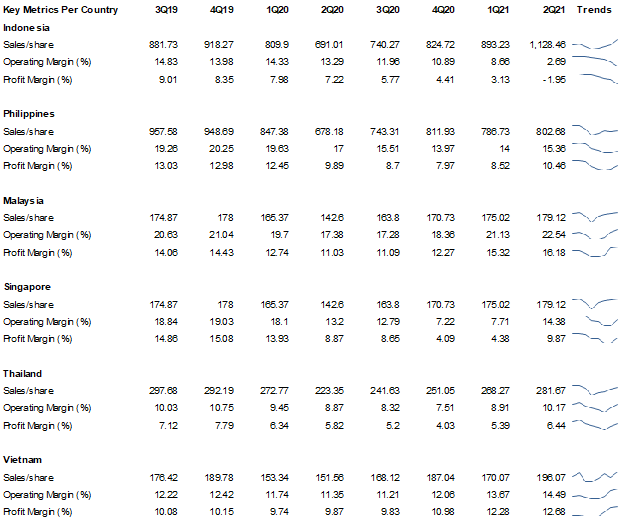

The below table shows the key metrics per market in the region.

As shown, companies listed in Malaysia and Thailand are showing similar or higher operating margins than pre-covid despite lower sales. Vietnam shows an increase amongst all indicators. For the other markets we expect to see a similar trend for margins increasing as vaccination rates increase and economies continue to open further.