Fund Commentaries

3Q 2021 Commentary

Third Quarter 2021 Commentary

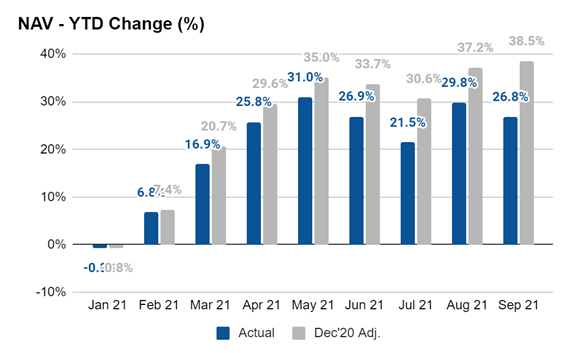

In the Third Quarter of 2021, the Fund returned -0.1%, MSCI ASEAN was -0.4%.

Year to date, the Fund returned +26.8%, MSCI ASEAN was -3.8%.

For the past 12 months, the Fund returned +58.2%, MSCI ASEAN was +15.8%.

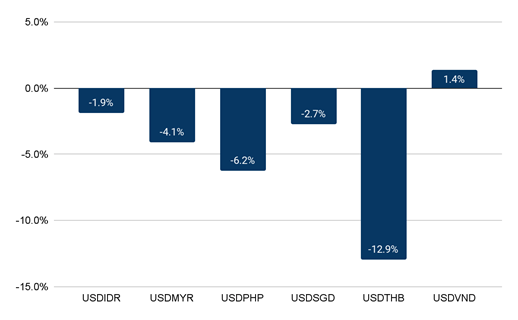

Currency Impact

Since mid-June US Federal Reserve meeting, which hinted towards a potential tapering of asset purchases and a potential interest rate hike, the currencies in the region declined, having a direct impact upon the performance of the Fund in the short term.

Graph 1: Fund performance comparison excluding currency impact

As shown, the decline in ASEAN currencies, especially the Thai Baht, which since Mid-June declined a further -7.8% to -12.9% for the year.

Graph 2: ASEAN YTD Currency Performance versus USD

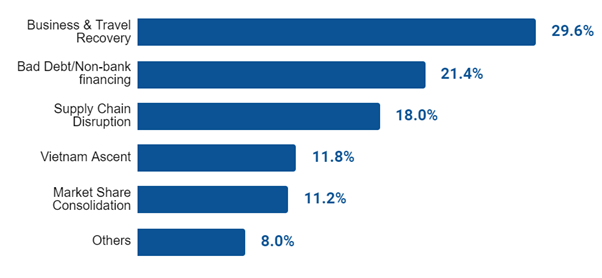

Strategy

Since May/June all of the ASEAN region has been in a form of lockdown, with restricted mobility, travel restrictions, and the inability for small businesses to operate. This situation has led to our continued viewpoint that the businesses in the following industries will continue to thrive:

- Supply chain

- Commodities

- Market share/business recovery

- Non-bank financials/bad debt collection

- Vietnam

Graph 3: Key Sector Weightings

Key Investment Changes

Vietnam

Over the past 6 months, we initiated new positions in Vietnam, allocating ~3% each into VTP VN and GMD VN.

VTP VN

Viettel Post is Vietnam’s post office that has expanded its services to become one of the key beneficiaries of the continuing expansion of e-commerce in the country. We began accumulating the shares during the Second Quarter as the company has the second largest network with 300,000 points of sales thanks to the relationship with Viettel, the country’s main telecom provider. Due to the continued investment in IT Systems, rolling out digital postal offices, ramping up e-fulfillment and cargo logistic services, the company is benefiting and capturing the e-commerce industry expansion, Vietnam’s economic growth, and increase in consumers spending ability. One key risk for the company has been the competition of private peers, such as the Chinese delivery companies that have engaged in price dumping which operate below cost. The Vietnamese government is currently issuing a decree on the postal market that will prevent unfair price competition that destabilises the industry, this is expected to be effective by the First Quarter of 2022, as VTP VN is a state-owned enterprise, this will be beneficial to their operations. Finally the shares should be moved from the small board to the main board in 2022.

GMD VN

Gemadept is a Port and Logistics operator in Vietnam. We have been tracking the company’s performance since we first met them five years ago and during the Second Quarter began accumulating shares as the group’s corporate structure and financial performance improved. Importantly the key capital intensive investment period in the new port, Gemalink, was completed, which is the key driver for GMD going forward. Vietnam is known as a manufacturing powerhouse in the region that continues to attract FDI, and one of the simplest ways to benefit from this is via the port operators. Going forward as a result of Gemalink Phase 1, GMD’s profits should increase by +50% in 2022, and with Gemalink Phase 2 launching in 2023, we expect that profits will be 2-3x higher by 2025.

Commodities

We increased our exposure in ITMG IJ to 4%, a coal mining company listed in Indonesia. Due to the continuous increase in coal prices, ITMG is expected to pay an interim dividend of 6% in November and an additional 12% dividend post the book closures of 2021. It’s 1H21 profits are already 300% higher than its 2020 profits and is currently trading at PE21 of ~9x. Should coal prices maintain their current levels throughout 2022 then the shares are valued PE22 of 2x.

HIBI MK is one of our oil related companies, held since 2Q20, the company announced their first dividend since listing on the Malaysia bourse, its first since its IPO. It currently trades at PE21 of ~12x, and if oil prices are maintained here then PE22 of 6x.

PTTEP TB, the large oil and gas company listed on the Stock Exchange of Thailand, has had a torrid 1H21 due to the recognition of hedging losses in the oil market. These hedging instruments are expiring during the third quarter of 2021 and going forward we expect that the company will be paying high single digit dividends and recognising profit growth of 2-3x in 2022, thereby valuing the share price at ~8x PE22.

Despite the investment commentary regarding high valuations, within the commodity equity space attractive valuations do still exist in capital markets. One question we have debated internally is that despite our positive outlook on commodities in general, why do we not have a far higher weighting these equities? The fear is that the governments of the respective countries where the companies operate may enact price cap measures thereby limiting the potential profitability of these entities or export limitations for national energy security purposes. Government overreach is proving to be the norm rather than exception today.

Supply Chain

Within the Supply Chain theme, dry bulk shippers specifically, PSL TB and TTA TB were our largest two weightings at ~15% of the Fund. Whilst the outlook for the companies, as we wrote here, is incredibly positive, due to the strong share price performance this year and opportunities that appeared due to the impact of lockdowns throughout the region, we reduced the weightings in both positions to a combined weighting of ~7%. Finally, we fully exited SONIC TB, a logistics player that was added during the Second Quarter, again due to its strong share price performance.

Non-Bank Financing/Bad Debt

During the Third Quarter there was a surprise announcement related to our key holdings, JMART & SINGER.

The details are as follows:

Private Placements (“PP”)

- VGI will subscribe via a PP to hold 15% in JMART injecting THB 6.26 bn.

- U will subscribe via a PP to hold 9.9% in JMART, injecting THB 4.13 bn.

- Thus JMART will receive a total of ~THB 10.39 bn.

- U will subscribe via a PP to hold 24.9% in SINGER, injecting THB 7.15 bn.

Rights Offerings (“RO”)

- SINGER will do an RO of ~THB 3.5 bn.

- JMT will do an RO of ~THB 10 bn.

These corporate actions will be completed within this year.

Our viewpoint is that the combination of the BTS Group entities and the JMART Group entities is beneficial due to the potential sharing of customer bases, distribution, and fintech systems. With BTS Group, JMART’s entities will have access to entities such as VGI TB, mass transit marketing, PLANB TB & MACO TB, OOH marketing, KEX TB, a key logistics player, and several other businesses. Simply, this combined with the capital injection into the JMART Group companies will reduce financial costs and allow for great market share expansion, in an industry that we are very positive on as written here.

As a result of the BTS Group entities investing into the JMART Group listed entities, we increased our weighting in JMART TB, added U TB which acts as the core holding vehicle for the BTS Group entities, and re-invested into JMT TB as the capital injection into the company will allow it to capture more of the potential NPL opportunities that are and will arise as a result of the lockdowns in Thailand.