Fund Commentaries

3Q 2022 Commentary

Introduction

What is considered a developed market and an emerging market today? Observing the events in the currency markets of Japan, Europe and the UK versus ASEAN calls these definitions into question. The US Dollar foreign reserves for the UK is $109 bn, whilst for Thailand it's $180 bn, Indonesia at $118 bn and Vietnam at $92 bn. The one positive with the gyrations in the capital markets is that calculations are far simpler with the US Dollar, Euro, British Pound and the Swiss Franc all close to parity.

Summary

- Performance

- Key Movements

- King dollar

Performance

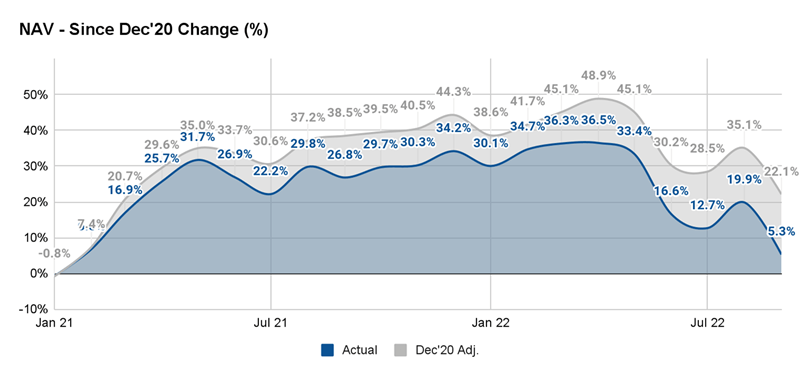

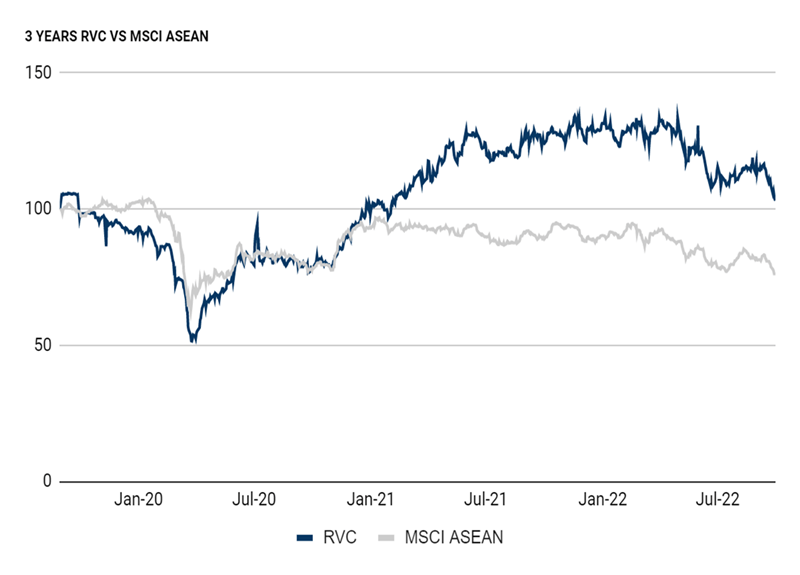

Over the past three years, the RVC Emerging Asia Fund returned +6.5%, versus the MSCI ASEAN which declined -22.6%.

Over the past two years the RVC Emerging Asia Fund returned +31.4% versus the MSCI ASEAN which declined -0.8%.

In the third quarter of 2022, the RVC Emerging Asia Fund returned -9.7%% versus the MSCI ASEAN which declined -2.7%.

Key Movements & Weightings

Key Movements

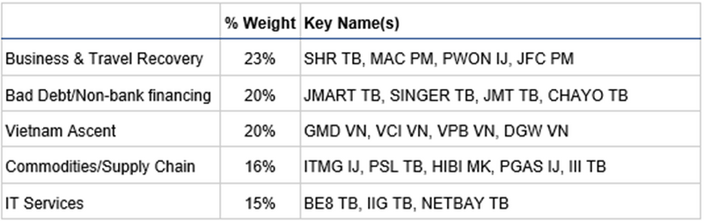

The Fund was active during the third quarter of 2022, as a result of the movement in the markets due to currency fluctuations, fears over interest rate hikes and multiple other factors. The regional markets offered attractive opportunities, specifically in Thailand & Vietnam capital markets, and thus the key movements during the quarter were as follows:

- During the quarter we increased cash to near 20% and re-deployed towards the end of the quarter as share prices were falling.

- Thailand - Tourism:

- Fully exited CENTEL TB (3%) due to the share price reacting positively to the continued increase in tourism figures into Thailand, as the share price has already recovered to 2018 levels. Fully exited MBK TB (1.5%), which was a new position at the beginning of the year, was sold due to the share price appreciation towards fair value during the 3Q22.

- Increased and initiated positions in tourism-related names such as SPA TB (2%) and KISS TB (1.5%). SPA TB provides spa related services and KISS TB focuses on cosmetic goods.

- Vietnam:

- Increased the country weighting in Vietnam to 20% of the Fund. Specifically, we initiated positions in both DGW VN (2%) - an IT distributor and MWG VN (1%) - the well known consumer group, as valuations became attractive at single digit PE’s and share premiums on MWG VN had disappeared for the first time in multiple years.

- Philippines:

- DNL PM (1.5%) - We initiated a new position in DNL Industries which engages in customisation, development and manufacturing of food ingredients, colourants, additives and engineered polymers for plastics, aerosol products, as well as manufacturing of oleochemicals, resins, and powder coating. The company is expanding capacity by 100% which is operational in January 2023 and should reach full utilisation by the end of 2024.

- Others:

- TRUE TB (1.5%) - For the past 12 months the merger of DTAC TB and TRUE TB has been debated by the authorities and on each occasion that the merger may be denied, the share price of True declined before eventually recovering, for the third time in 12 months we bought and sold the shares. Should there be another delay in the merger, we will take advantage of any dip in the share price.

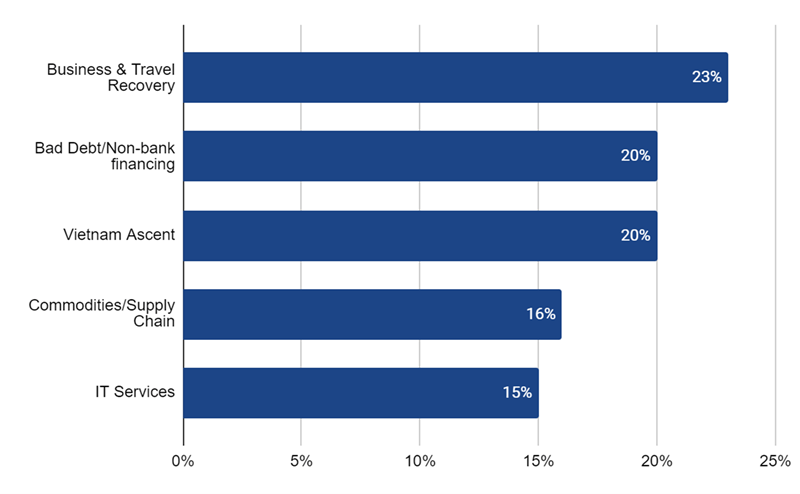

Weightings by Category

KING DOLLAR

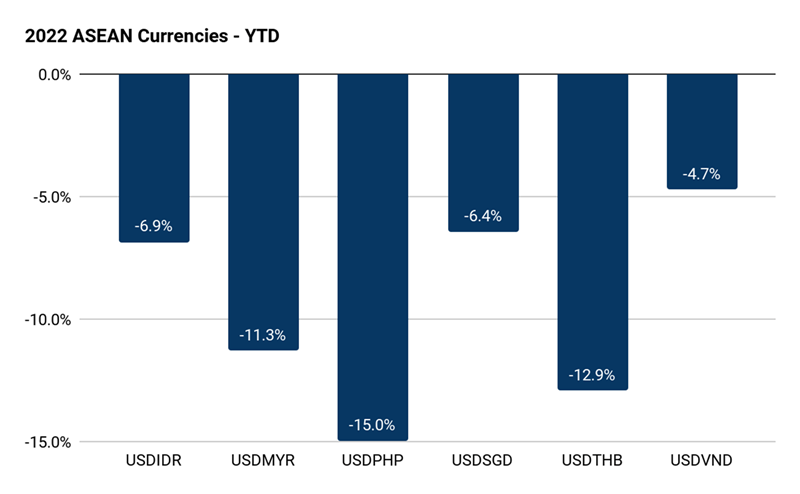

As we wrote in the 2Q22 Commentary, the King Dollar continued to roar, thereby negatively impacting our performance. The strongest declines for the year continue to be both the Thai Baht and the Filipino Peso. As with other periods of historical dollar strengthening we are of the opinion that going forward from the third quarter 2022, that we expect to see ASEAN currencies recover strongly.

Should the Fund be priced in Euros or British Pounds then it would be close to flat for the year.

As of the end of September 2022, the weakest performing currencies are the Malaysian Ringgit, Philippine Peso and the Thai Baht.

Since the end of December 2020, we estimate that the US Dollar’s strength has negatively affected the Funds returns by -18%.