Fund Commentaries

1st Quarter 2024

Summary

- Performance

- Country Thoughts & Weightings

- Key Movements & Weightings

Performance

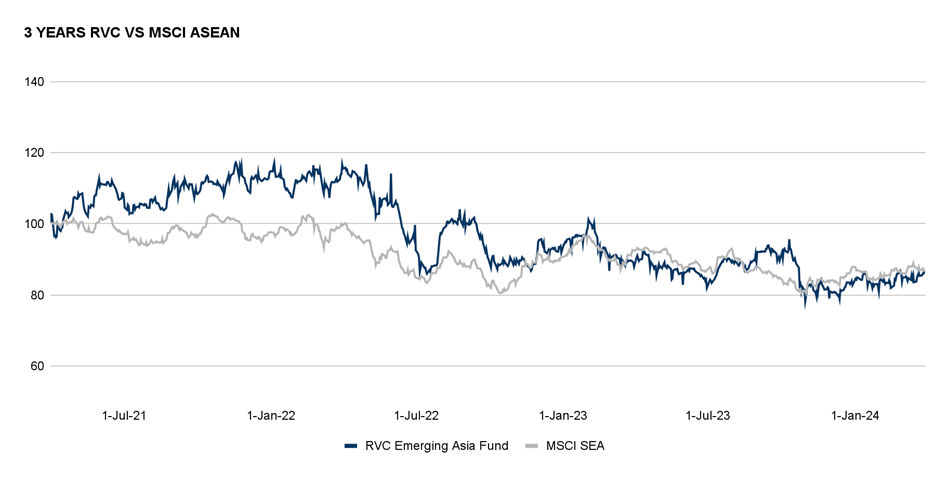

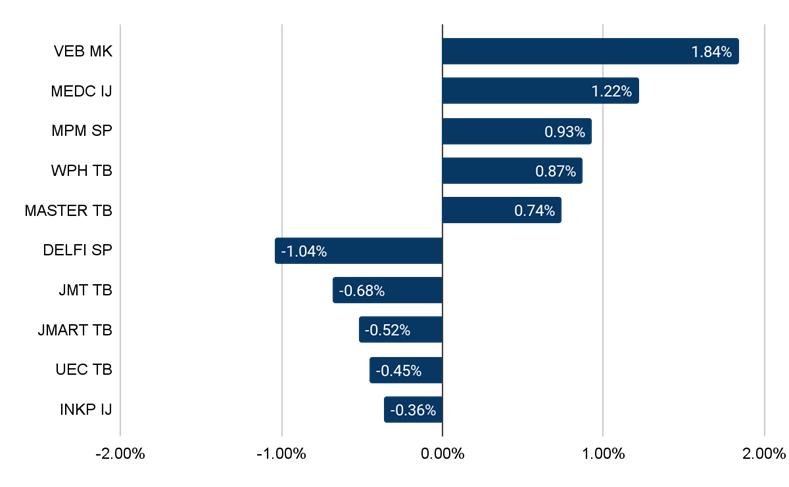

Over the past month, the RVC Emerging Asia Fund returned +1.9%, versus the MSCI ASEAN which returned +0.7%.

For 1Q24, the RVC Emerging Asia Fund returned +3.2%, versus the MSCI ASEAN which returned -1.3%.

Over the past 12 months, the RVC Emerging Asia Fund returned -2.9%, versus the MSCI ASEAN which returned -6.2%.

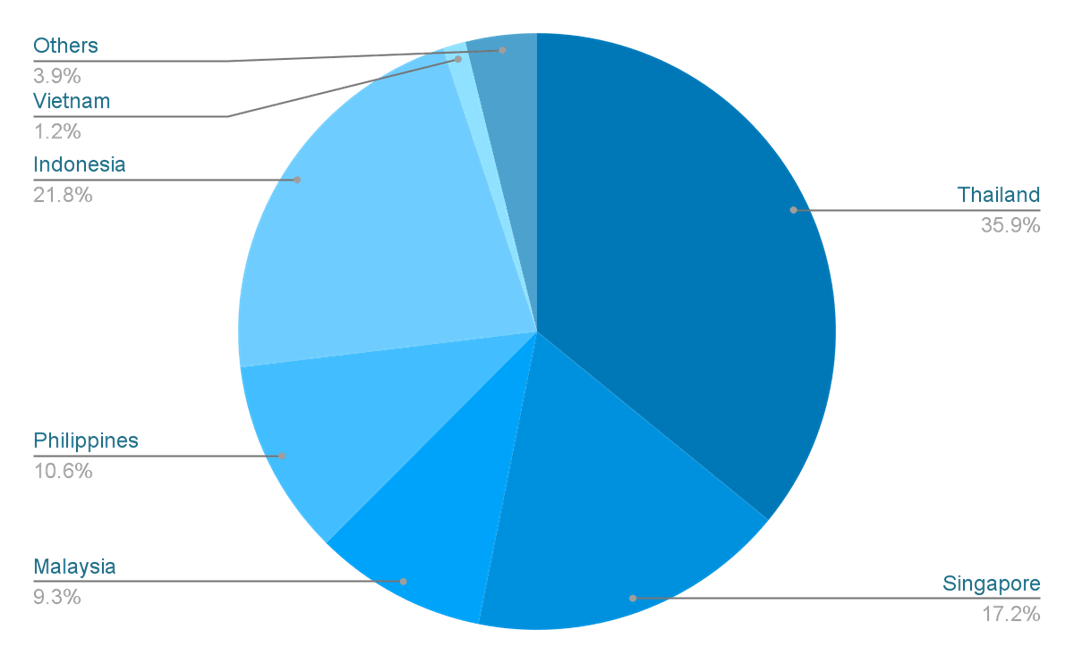

Country Thoughts & Weighting

Indonesia

Back in November 2023 we wrote, Indonesia terbang ke bulan, a simple google translation would tell you that it’s going to the moon.

https://www.rossvancompernolle.com/document/musings/419/riding-the-waves

The Indonesian election proceeded smoothly with Prabowo’s team winning it comfortably. Thus the continuation of the policies from the Jokowi era governments are expected to continue. Amusingly, and as expected, fiscal government spending in Indonesia had slowed until the confirmation of Gibran, Jokowi's son, as a Vice Presidential candidate. Once approved, the government’s fiscal spending picked up again towards the end of the 4th Quarter 2023 and throughout 2024. We have seen this translated into the share price performance of our holdings with ERAA IJ +30%, SIDO IJ +35%, and ARNA +15% since mid November until the end of 1Q24. These three holdings are 20% of the Fund as of writing.

It shall be interesting to see the developments throughout the rest of the year in the political arena as the mayoral/governor elections are also occurring this year. There have already been further announcements of household cash assistance, higher fertiliser subsidies to shore up rice production and no electrical nor fuel price hikes until June. The government is projecting a higher deficit for its 2025 budget, which means higher economic growth and more handouts. The continuation of this era shows that Indonesia could result in a consistent increase in GDP growth from +5% to +6% and a stable currency. Traditionally we would not comment on politics, but as governments are becoming a larger portion of GDP thereby becoming an important market participant, to deter the outlook for any country or industry, it is now necessary to understand their governments direction.

To see the consolidation of power in Indonesia in the short term is going to be wondrous for business. We expect that the infrastructure investments continue, ease of doing business continues to improve, FDI continues to impress. These developments have translated into a strong stock market for Indonesia for the past few years and the trend is likely to continue. But the destruction of the independence of institutions will eventually hurt Indonesia, perhaps in the next 3 decades, which is outside of our time horizon. Thus we observe this creation of a new Javanese emperor and shrug, it is after all Indonesia.

Until then, Indonesia, a nation of 250 million, is a hidden investment powerhouse as within its population lies a remarkable diversity. A significant 5%, roughly 12 million, boast a GDP per capita comparable to Singapore's, effectively creating two Singapore-sized economies thriving within Indonesia. Furthermore, 60 million Indonesians enjoy a Thailand-like GDP per capita, adding another substantial market equivalent to one Thailand. The remaining population has a GDP per capita similar to the Philippines, creating a vast consumer base with strong growth potential. This translates to unparalleled diversification for investors – exposure to established markets like Singapore and Thailand alongside a burgeoning Philippine-sized consumer segment, all within a single nation. Combined with the continued FDI, tailwind of demographics, and consistency in policies, this is why Indonesia terbang ke bulan.

Key Movements & Weightings

Key Movements

The key movements during the quarter were as follows:

Exits

HIBI MK (Mkt Cap: MYR 2.2 bn/USD 471 mn)

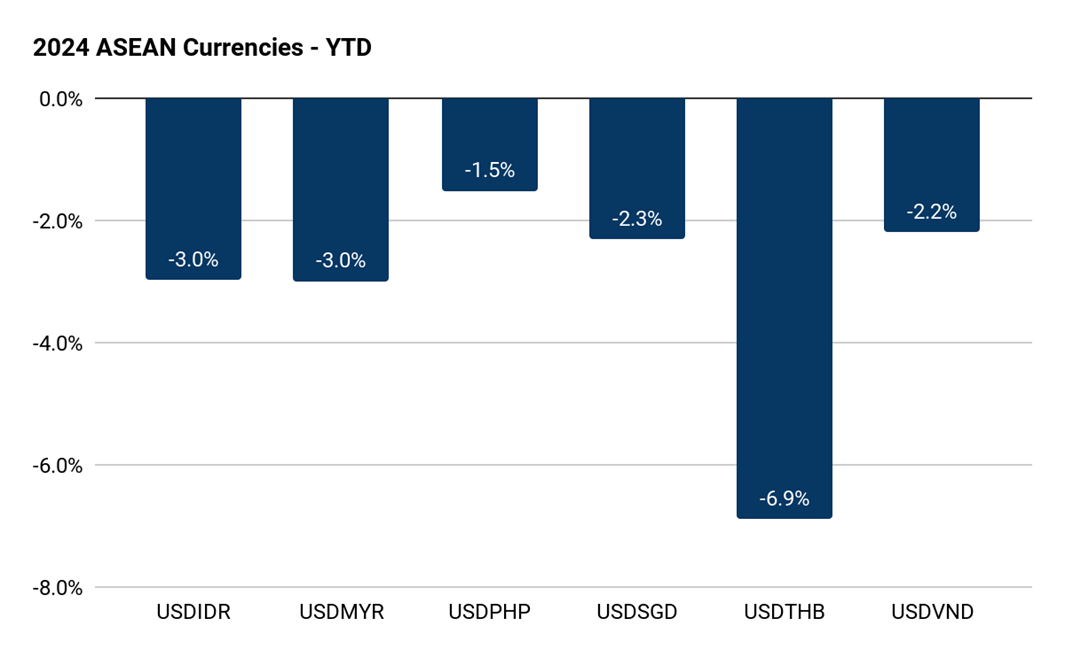

We have been holding HIBI MK’s shares since 2020, at times its weighting was close to double digits and other times at just 1-2% depending upon where oil prices were. We fully exited the position in 1Q24 as despite the continued great performance of the company, the shares trading at 4x PE, the board and management being proactive in returning capital to shareholders via the form of share buybacks, the share price continued to remain flat for the past 24 months and the Malaysian ringgit declined -14%, it would be prudent to simply exit.

MWG VN VND (Mkt Cap: 76,900 bn/USD 3 bn)

MWG VN was one of our key acquisitions during the 2022 crash in Vietnam’s stock market. As a key proxy for consumer confidence and spending power, the company’s performance improved as anticipated and as the share price recovered with the market, we elected to fully exit the position.

New holdings

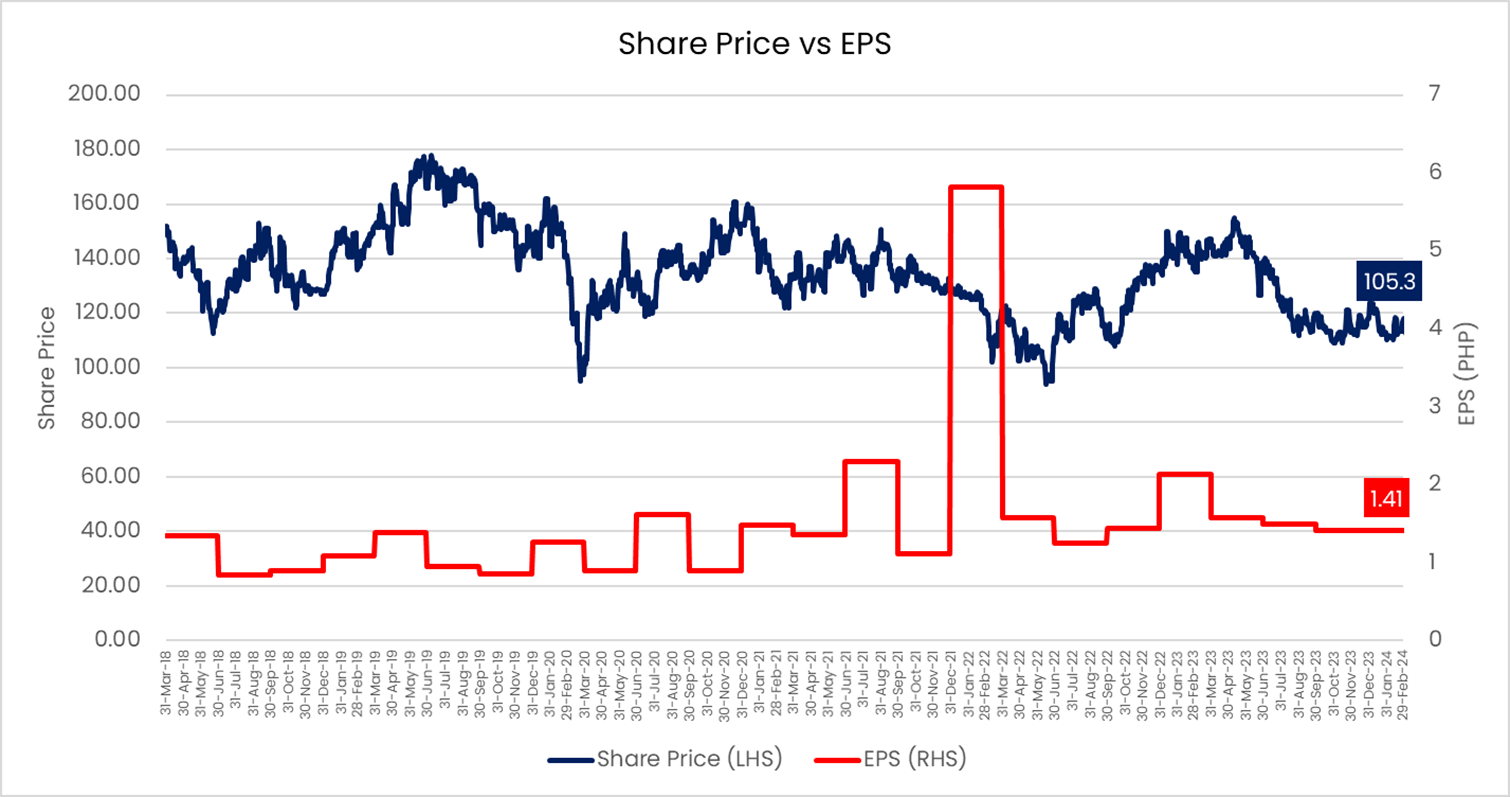

URC PM (Mkt Cap: PHP 230 bn/USD 4 bn)

Universal Robina Corporation (URC PM) is listed on the Philippines Stock Exchange, it produces and distributes branded consumer foods. The Company's products include snacks, beverages, meats, eggs, instant food, instant drinks, flours, and pet products. URC products are distributed to countries in Asia.

The company’s share price is now trading near its 2020 Covid low, and the 2022 Fed rate hike lows. With the company now trading at 15x trailing PE, revenue is expected to grow +8-9% in 2024 and due to margin improvements from lower costs, net profits to increase +13-15%. The current valuation, outlook and the share buybacks provide us comfort acquiring shares at these levels.

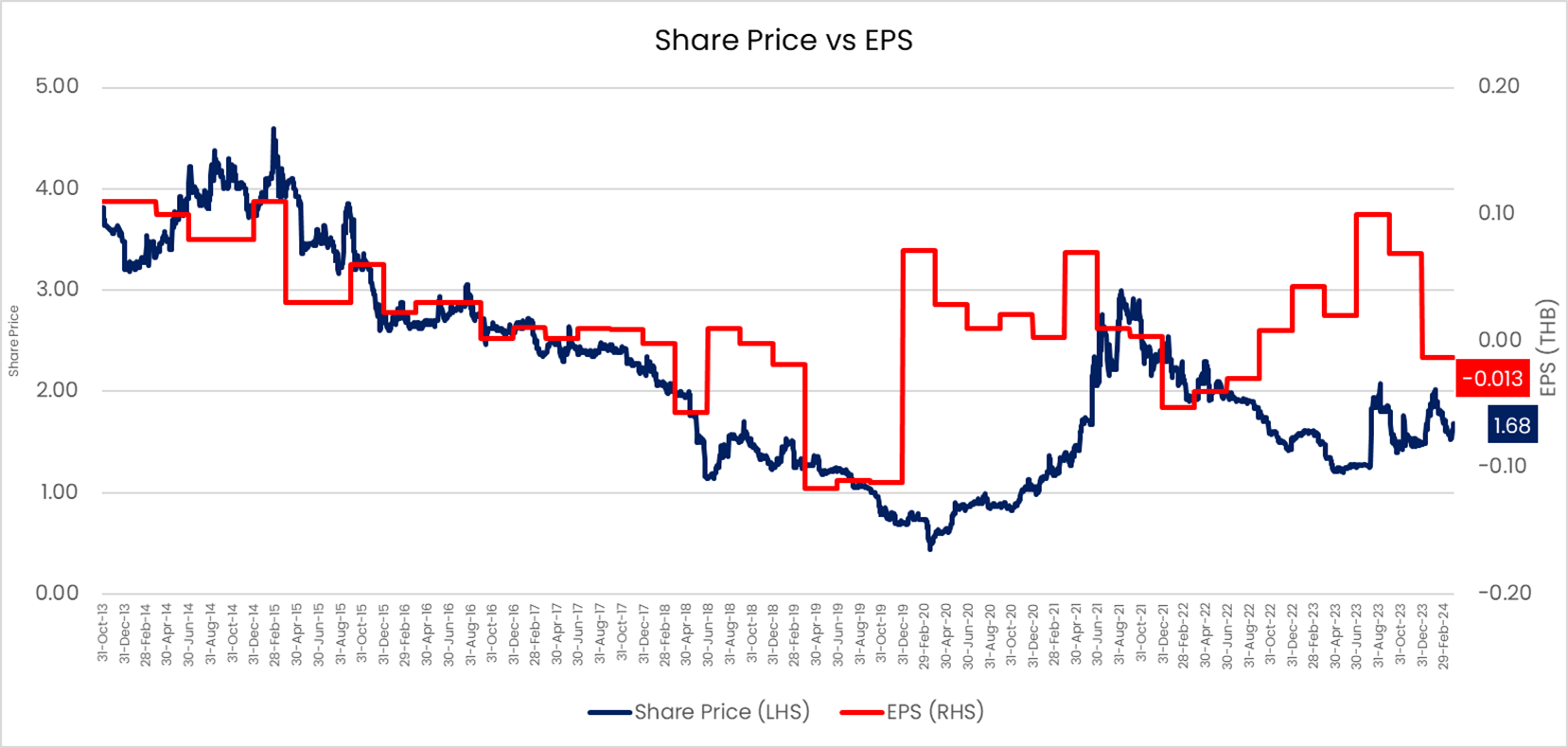

UEC TB (Mkt Cap: THB 926.6 mn/USD 25.1 mn)

Unimit Engineering Plc (UEC TB) is a Thai publicly listed company. Its core business is the design, fabrication, and construction work of steel products as per customers requirements such as large pressure vessels, machinery parts, non-pressure tanks, steel & mechanical structures and their customer base are the companies from the oil & gas industry.

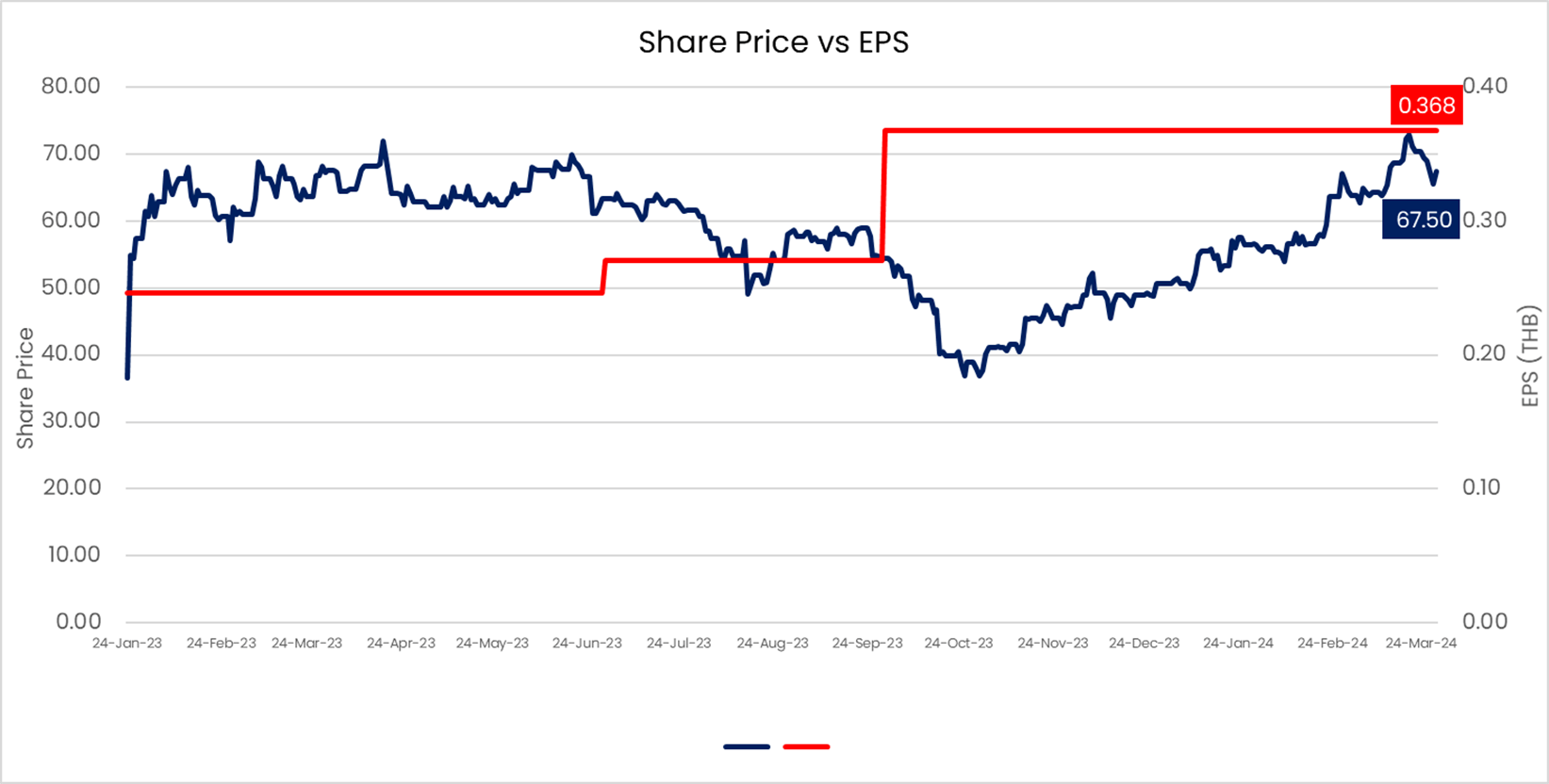

If you were an investor in Thai equities in the mid-2000’s, then this company may be familiar to you as the share price went from THB 2/share to THB 12/share from 2006 to 2008. At my previous firm it was one of our first multi-baggers, today the story is the same as then, UEC is a key beneficiary of the oil & gas capex cycle with no domestic competition and minimal regional competition.

As with our other oil & gas service provider holdings, 2023 was the first genuine year of oil & gas capex projects and this is a 5 year cycle. UEC reported a strong profit in 2023, its trailing PE is 8x, or 4x Net cash, with a dividend yield of 12%. Going forward we expect to see profits increase by +30-40% and the company has a consistent dividend policy, thus the dividend yield could increase to 16-17% for 2024. Further given the lack of competition in the region, we believe that UEC is a prime M&A target.

MASTER TB (Mkt Cap: THB 20 bn/USD 551.1 mn)

Master Style Plc (MASTER TB), a Thai publicly traded company, is an attractive proposition due to its dominance and strategic acquisitions in the flourishing beauty and wellness sector. Boasting a near 90% market share in Thai aesthetic and cosmetic surgery, the company has a loyal customer base and strong brand recognition.

MASTER is the perfect Thailand play as it's a combination of hospitals/hospitality, tourism, and ladyboys (plastic surgery).

MASTER’s ambition is to be a specialty hospital, not only in aesthetic plastic surgery but also in other fields. Its business expansion strategy focuses on the merger and partnership (M&P) model, where MASTER takes an equity stake rather than acquiring a whole company. MASTER has been aggressive in M&P deals as it sees opportunities in the highly fragmented market. Since its IPO in January 2023, MASTER has announced 15 M&A deals worth up to THB 2.3bn, with investment stakes ranging from 15-40%. Of the total 15 announced deals, 84% of the investment is in the aesthetic segment and 11% in two media and advertising companies.

The Thai beauty and wellness industry is booming while Thailand's reputation as a medical tourism hub attracts international clients, especially Chinese and SEA tourists, seeking affordable cosmetic procedures. MASTER is positioned to capitalise on this growth. With a diversified portfolio, strong marketing infrastructure, and a dominant market position, we forecast that MASTER’s profits will increase by +40% in both 2024 and 2025.

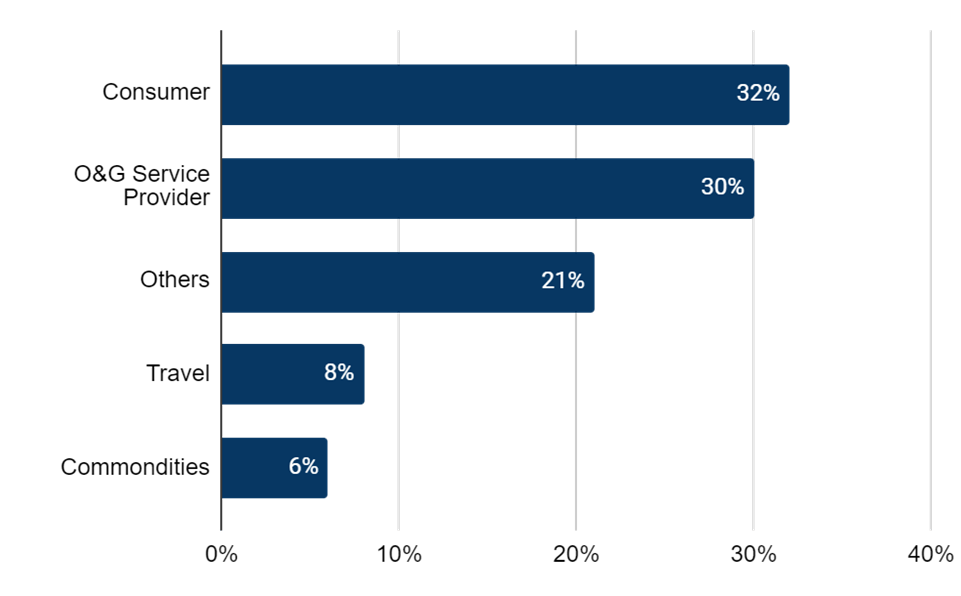

Weightings by Category

Top 5 Sector Weightings

Top 5 Positions (accounting for 32% of the Fund)

- VEB MK 8.3%

- MEDC IJ 6.7%

- CSE SP 6.3%

- ERAA IJ 6.1%

- WPH TB 5.3%

Top Contributors during 1Q24

Currency

As of the end of March 2024, the strongest performing currency is the Philippine Peso and the weakest performing currencies are the Thai Baht, Malaysian ringgit and Indonesian Rupiah.

Tickers mentioned

- HIBI MK - HIBISCUS PETROLEUM BHD

- MEDC IJ - MEDCO ENERGI INTERNASIONAL TBK

- SIDO IJ - SIDO MUNCUL

- VEB MK - VELESTO ENERGY

- WPH TB - WATTANAPAT HOSPITAL

- ERAA IJ - ERAJAYA SWASEMBADA TBK PT

- ARNA IJ - ARWANA CITRAMULIA TBK PT

- MWG VN - MOBILE WORLD INVESTMENT CORPORATION

- URC PM - UNIVERSAL ROBINA CORPORATION

- UEC TB - UNIMIT ENGINEERING PLC

- MASTER TB - MASTER STYLE PLC

- CSE SP - CSE GLOBAL LTD

- MPM SP - MARCO POLO MARINE LTD

- DELFI SP - DELFI LTD

- JMT TB - JMT NETWORK SERVICES PLC

- JMART TB - JAYMART GROUP HOLDINGS PLC

- INKP IJ - PT INDAH KIAT PULP & PAPER TBK