Musings

Riding the Waves

Why Oil & Gas Offshore Services?

Fund Weighting: 20%

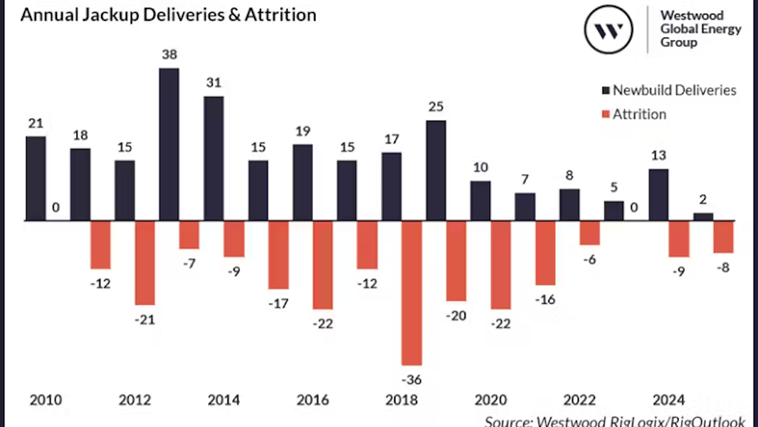

The thesis here is simple, there is a rapid increase in demand for the services and assets for oil & gas offshore services and there is a limited number of companies and assets available. The O&G offshore services industry has been starved of capital for the past decade. Due to the increased focus of ESG, sustainability, and renewable energy, this industry has been severely lacking in investments and capex, hence the current high oil price environment. As a result of two years of strong cash flows, the oil and gas industry has begun ignoring the shareholders that were anti-oil drilling and have begun announcing projects throughout the globe, our focus is in SouthEast Asia. A perfect example is in the offshore rigs, where the supply of offshore rigs is 50% lower than in 2014.

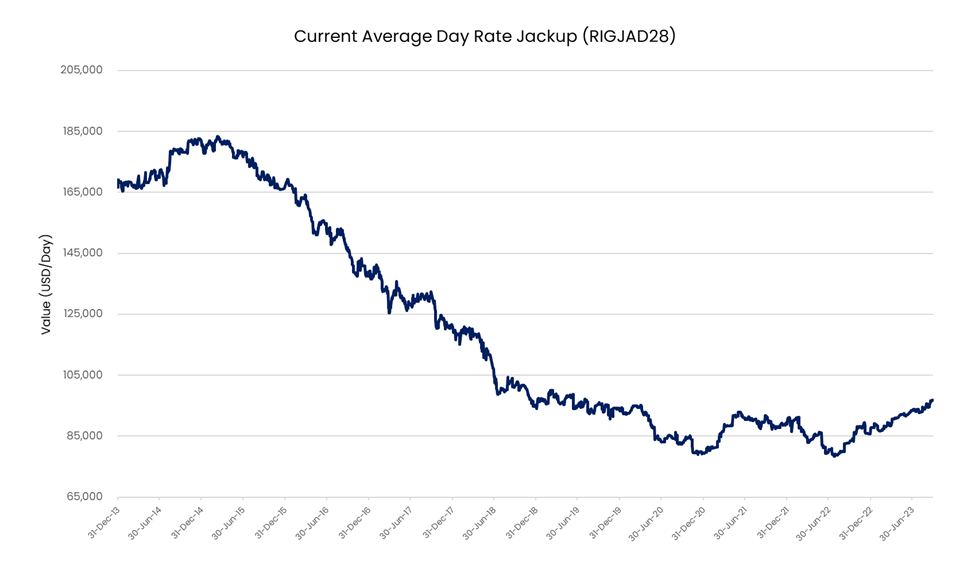

Daily Jackup rigs rates a year ago were USD 78,000/day. Today they are quoted at USD 97,000/day, an increase of +25%. A decade ago, the quoted daily rates were as high as USD 185,000/day.

According to S&P Global, the number of available rigs in Southeast Asia is forcing a shortage for 2024-2025, and as a result, S&P Global expects the Southeast Asian JU market to stay tight until at least end-2025. The SEA’s JU day rate averaged USD 118,550 (+4.8% QoQ; +24.7% YoY) in Q3 2023 and USD 117,400 (+38.1% YoY) in 9M 2023 as per S&P Global.

The reality on the ground has confirmed this with rigs, depending upon their specifications, are already achieving rates of USD 100,000 - USD 170,000/day. Recent examples include PTT Group extending a 15 month contract with Borr Drilling for USD 165,000/day, or our holding O&G holding, Hibiscus (HIBI) extending it’s contract with PetroVietnam Drilling (PVD), another one of our holdings, for its PVD III JU rig with Hibiscus (Malaysia) from October 2023 to mid-2024 at a day rate of ~USD 100,000/day.

Source: https://ca.finance.yahoo.com/news/borr-drilling-limited-nyse-borr-190744825.html

Is there a risk of new supply suddenly coming online?

According to Westwood Global Energy Group, “...building a new jackup could cost $250-300 million for a 400 ft-rated rig, with a delivery time of up to 2 ½ years. Jackup owners would expect a 15% ROI for a newbuild with 90-95% utilization and a dayrate of USD 200-230,000/day over the rig’s 25-year lifespan”

Thus we see limited risk in new supply coming online and as we will re-state below, several of our holdings market capitalisations are trading at 0.2x-0.5x the cost of new rigs.

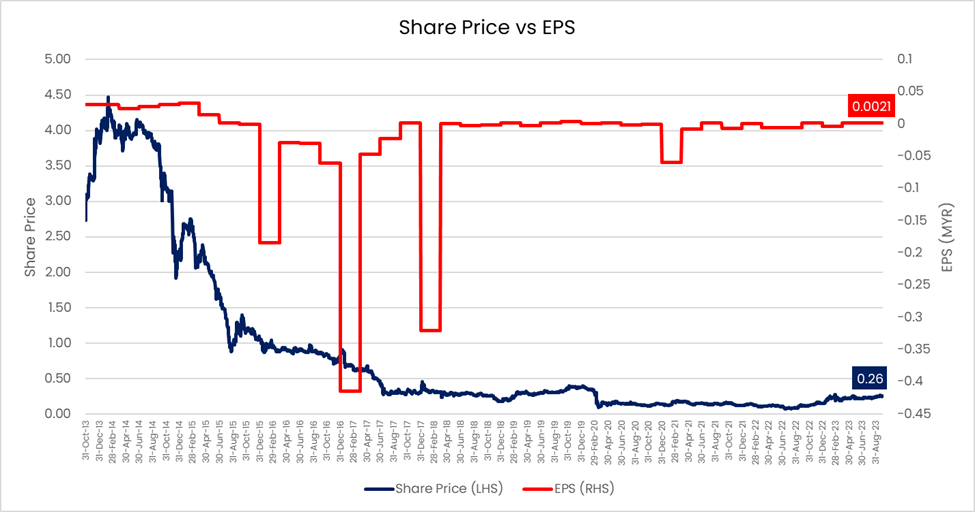

Velesto Energy Bhd (VEB MK) Market Cap. MYR 1.9 bn; USD 415 mn

Over the past decade VEB has gone through several restrictions, and currently has a debt-free balance sheet, with 9 JU rigs. It’s market capitalisation today is ~USD 400 million, therefore trading at 0.17x the cost of new rigs.

All of its rigs are fully leased out, and recently on the 28 November 2023, Velesto announced that it has secured a contract extension from Carigali-Hess Operating Company (CHOC) for its Naga 8 rig for another 18 months (from 19 Apr 2024 till 18 Oct 2025), ascertaining the rig at close to 100% utilisation rate for 2024. The total contract value for this extension amounts to USD74m, implying an effective DCR of approximately USD130,000/day.

Going into 2024, we expect to see VEB’s earnings grow by +250% and trading at 8x PE24 and 6x PE25.

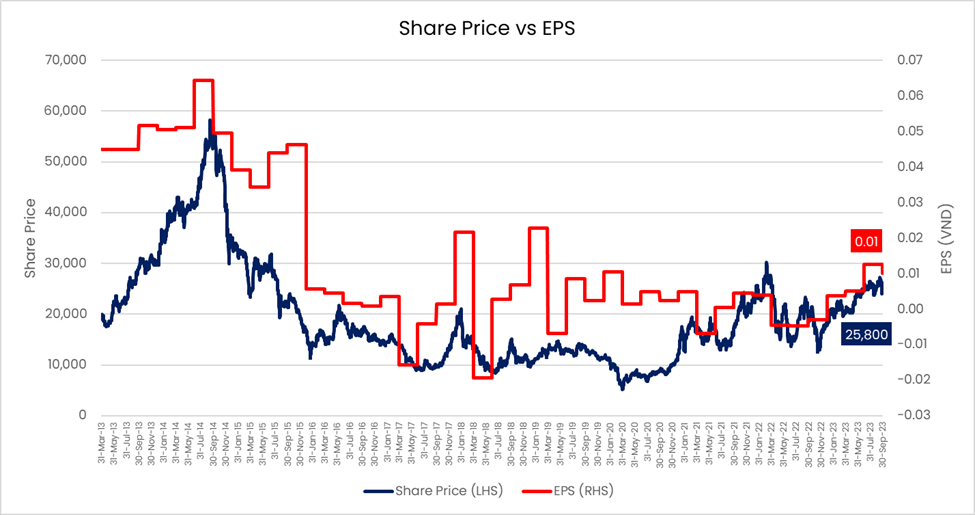

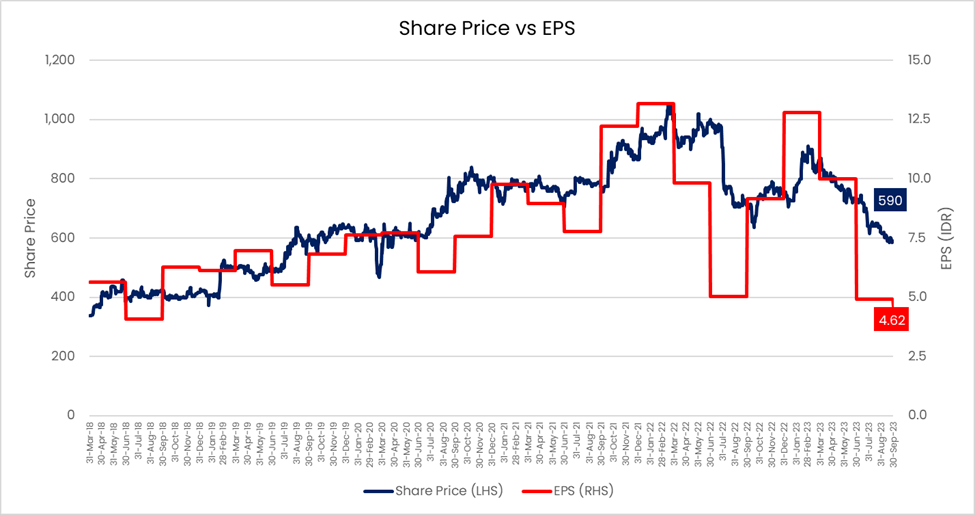

PetroVietnam Drilling (PVD VN) Market Cap. VND 15.8 tn; USD 654 mn

PVD is an SOE drilling Company based in Vietnam, it owns 6 Rigs and is a professional provider of drilling rigs and drilling-related services as well as manpower supply for onshore and offshore drilling operations with nearly 2,000 employees. Its current market capitalization today is USD 600 million, therefore trading at 0.4x the cost of new rigs.

All of its rigs are fully leased out and recently PVD extended the contract for its PVD III JU rig with Hibiscus (Malaysia), one of our holdings, from October 2023 to mid-2024 at a day rate of ~USD 100,000. Additionally, PVD has secured drilling contracts for nearly all its JU rigs until end-2025 at day rates of USD 90,000-100,000, which are higher than almost all its contracts in 2023. Further, Murphy Oil (the field operator) issued an FID for the Yellow Camel oil field on November 3, 2023. PVD plans to join bidding for this project; however, further details have not yet been disclosed. As per the field development plan, PVD may conduct drilling for this oil field starting in 2026 for 800 days (~2.2 years) with a total contract value of USD 294 million.

Going into 2024, we expect PVD’s earnings to grow +150%, trading at a PE24 of 15x and PE25 of 9x with a balance sheet that is practically debt free with a Net D/E of 2.6%.

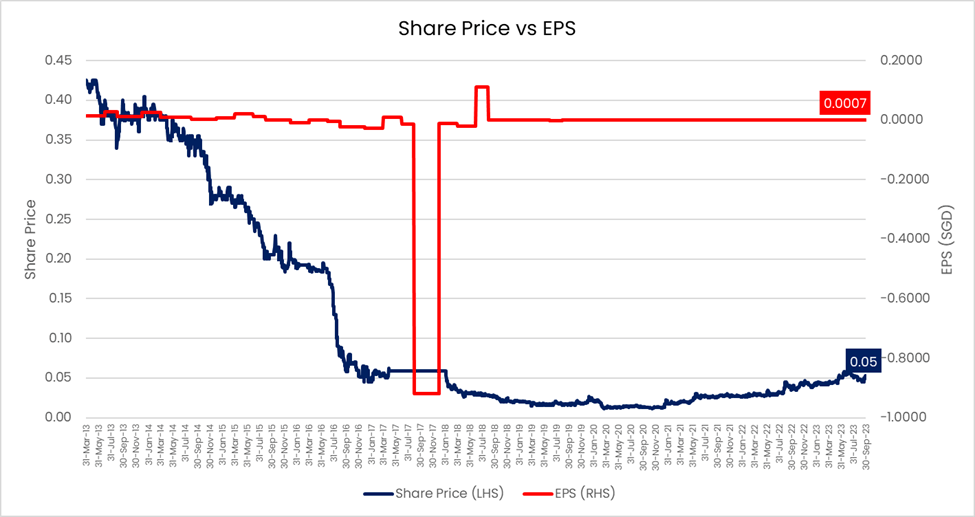

Marco Polo Marine Ltd (MPM SP) Market Cap. SGD 191 mn; USD 144 mn

MPM is an integrated marine logistic group facilitating the growth of investment in South East Asia.

The Group’s shipping business relates to the chartering of Offshore Supply Vessels (“OSVs”) for deployment in regional waters, including the Gulf of Thailand, Malaysia, Indonesia, and Taiwan, as well as the chartering of tugboats and barges to customers, especially those which are engaged in the mining, commodities, construction, infrastructure, and land reclamation industries. Under its chartering operations, the Group has diversified its activities beyond the oil and gas industry to include the support of offshore wind farm projects. The burgeoning offshore wind energy industry in Asia is at a nascent stage where structures are under construction, presenting tremendous opportunities for the Group whose fleet can support the development of these projects. The Group’s shipyard business relates to shipbuilding and providing ship maintenance, repair, outfitting, and conversion services through its shipyard in Batam, Indonesia. With approximately 34 hectares of land and a seafront spanning 650 metres, the shipyard boasts three dry docks, enhancing the group's technical capabilities and services allowing them to undertake projects involving mid-sized and sophisticated vessels.

For their Financial Year 2023, revenues increased +48%, net profits rose +82%, it is net cash with SGD 60 million, nearly half of its market capitalisation, and trading at PE5x net cash and for FY2024 at PE 3x.

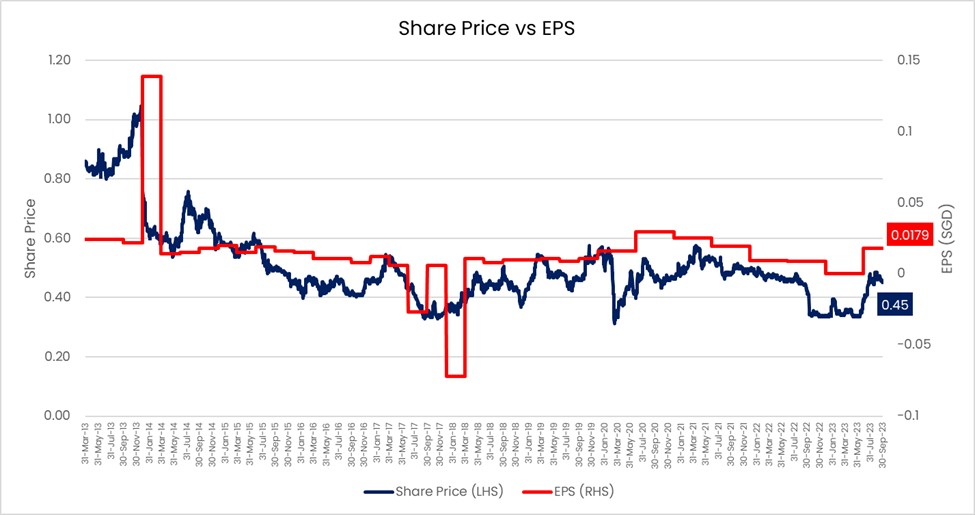

CSE Global Ltd (CSE SP) Market Cap. SGD 258 mn; USD 194 mn

CSE Global Limited provides systems integration and information technology solutions, computer network systems, and industrial automation. The Company also designs, manufactures, and installs management information systems. Its customers are global across the energy, infrastructure and mining & minerals sector.

The current backlog for the group is reaching an all time high of SGD 1 billion in value, with more than 50% of orders in electrification solutions in addition to the oil & gas customers that it services. This year its earnings are demonstrating a remarkable turnaround of +260% and the Company is likely to achieve +30% profit growth in both 2024 and 2025. Further these contracts have a maintenance revenue portion built in that provides a fantastic cash flow stream going forward. The Company’s balance sheet is close to net cash.

The shares are currently trading at a Market Capitalisation of SGD 260 million, below book value, offers a dividend yield of 6% to 10% over the next three years and is trading at a PE24 of 9x and PE25 of 7x. The shares are currently trading at SGD 0.425/share and the CEO has been accumulating shares, as high as SGD 0.47/share.

Indonesia terbang ke bulan

Fund Weighting: 28%

Why Indonesia? One reason, the election.

In February 2024, Indonesia is holding the Presidential election, for our viewpoint on the potential outcome feel free to contact us. On the investment side, first a quick review of what Joko’s administration has been able to achieve over the past 8 years.

“ Downstreaming of mineral resources has increased export value-added and spurred foreign investment. Following the ban on nickel ore exports in Jan 2020, nickel exports have surged more than eightfold to 777.4 million kg last year (vs. 93.1 million kg in 2020). There were 43 nickel smelters in operation as of July 2023, up from 11 in 2019. Nickel-related jobs in Central Sulawesi and North Maluku have risen to 71.5k (vs. 1.8k previously) and 45.6k (vs. 500 previously).

Jokowi’s infrastructure policies have been dominated by megaprojects including toll roads, airports, power plants and construction of a new capital Nusantara.

Infrastructure investment has been ramped up under the Jokowi administration, particularly during his 2014-19 term. As a share of total government expenditure, infrastructure spending nearly doubled to 16.1% in 2017-19 from 8.6% in 2012-14. About 2,040 km of toll roads have been developed since 2014, nearly threefold of the 780 km under the preceding Yudhoyono administration ”

Source: Maybank Indonesia Economy Report, November 2023

In the First Quarter of 2023, we mentioned that we would disclose Indonesian consumer names that we believe are attractive holdings. However, as the Indonesian consumer was battered by the removal of subsidies at the beginning of 2023, and higher inflation, we held off until now. At the end of October, the fiscal package announced includes an extension of chicken & rice handouts to households, cash handouts to poor families affected by El Nino. The cash aid is currently being distributed to households. In addition to this, the 11% VAT on home purchases worth less than Rp 5 billion will be scrapped until June 2024, after which it will be halved until end-2024.

Indonesia is currently undergoing a massive boost from fiscal packages and election spending in what is going to be an exceptionally important year for the political candidates in 2024.

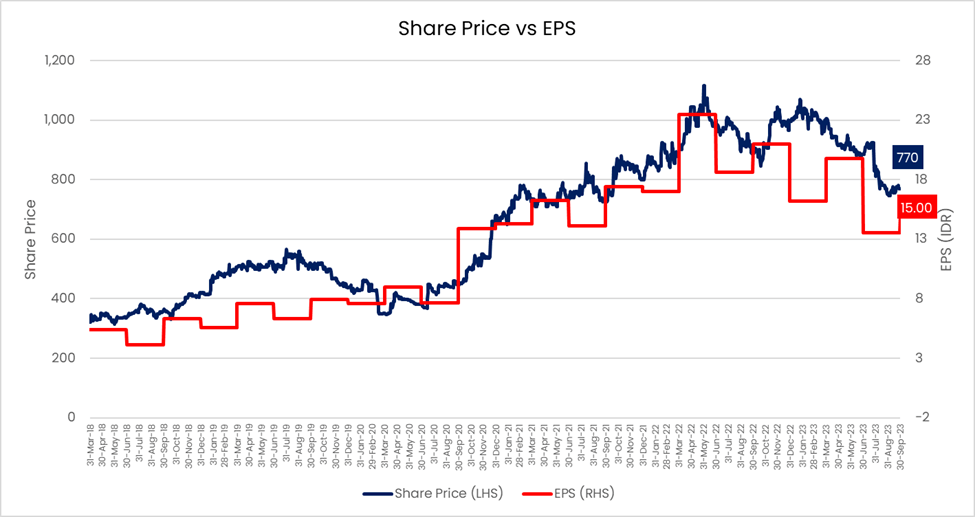

PT Arwana Citramulia Tbk (ARNA IJ) - Market Cap. IDR 5.1 tn; USD 327 mn

PT Arwana Citramulia Tbk manufactures ceramic construction material for flooring. Through its subsidiary, the Company also distributes its products. The Company's factory is located in Tangerang, Banten.

ARNA is continuing to expand its capacity, with the recent completion of Plant 5C, and has announced the construction of Plant 6 commencing in the second half of 2024. This will increase their capacity to 70 million m2 p.a. As the newer plants are to manufacture higher end ceramic products. This implies the strong potential shift towards higher margin products thereby increasing the Company’s revenues by both volume and price and higher profit margins. The demand in Indonesia for their products come from a close combination of renovations and new builds. The renovation market still has substantial growth potential as the majority of homes are still cement flooring.

Currently the shares are trading at PE10x earnings with an 8% dividend yield, and we expect earnings growth to be in the high mid teens for the next two years.

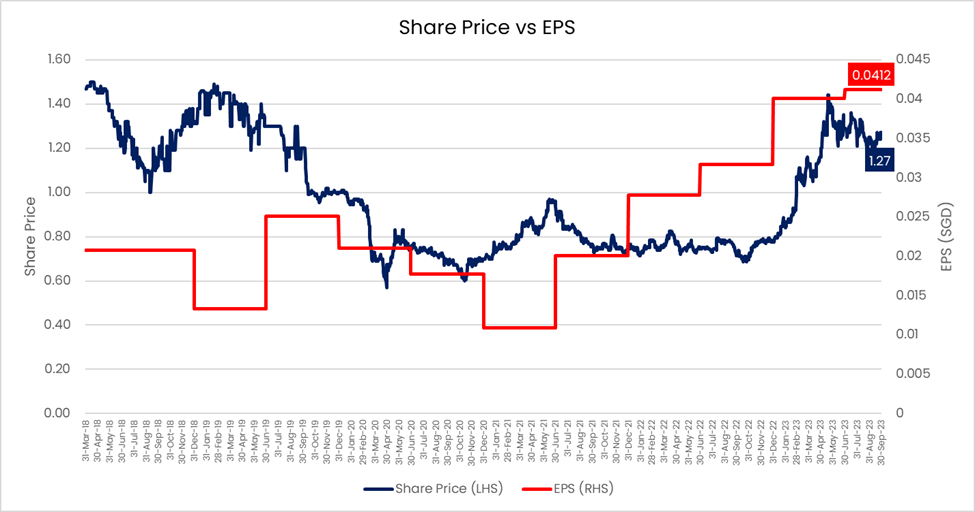

Delfi Ltd (DELFI SP) - Market Cap. SGD 678 mn; USD 510 mn

Delfi manufactures, markets and distributes chocolate confectionery products. The Company offers a broad range of chocolate and sugar confectionery products such as moulded chocolates, dragees, enrobed wafers, biscuits, and increasingly more healthy snacks.

Delfi's position as the market share leader in Indonesia's chocolate industry is a testament to the strength of its brand portfolio and its ability to cater to the evolving preferences of the country's growing middle class. Delfi's success in maintaining its market leadership reflects its grasp of the local consumer tastes and its continuous efforts to innovate and expand its product offerings.

Delfi’s market share in Indonesia is 45%, far ahead of competitor Mayorah Indah’s 25%. Its brand names SilverQueen, Ceres, Delfi, and Goya have been consumed by 4 generations of Indonesians over six decades, building up significant consumer mindshare in the process. Indonesians have grown accustomed to the typically less-sweet and less-milky type of chocolate that Delfi is offering. In addition, the Company controls a distribution system with access to 400,000 points-of-sale across a country that does not have proper cold-storage logistics.

Its latest figures for 9M23 profit showed US$ 32.8 million (+22.1% YoY), Delfi reported 9M23 revenue and US$ 412.6 million (+15.2% YoY). Financially, it has a net cash balance sheet, it is currently trading at PE10x and should comfortably continue to grow at 15-20% for the next two years.

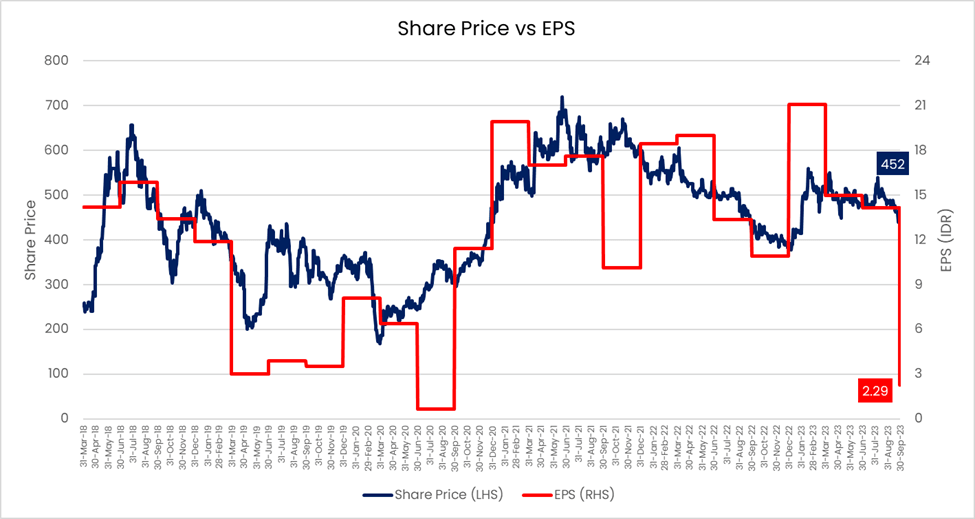

PT Erajaya Swasembada Tbk (ERAA IJ) - Market Cap. IDR 5.7 tn; USD 371 mn

PT Erajaya Swasembada Tbk is an Indonesia-based importer, retailer and distributor of telecommunication equipment. The Company's business verticals include Erajaya Digital, Erajaya Active Lifestyle, Erajaya Beauty and Wellness, and Erajaya Food and Nourishment. Its Erajaya Digital is focused on consumer electronics, handsets, laptops, computers, operator business and vouchers, as well as other relevant products with various store concepts, from multi-brand concepts like Erafone store to monobrand concepts, such as iBox, Samsung, Mi-store and other brands. Its Erajaya Active Lifestyle is engaged in the sales of lifestyle-related products, such as accessories, Internet of things, sport fashion apparel, as well as other outdoor activity-related products. Its Erajaya Beauty and Wellness is engaged in the sales of beauty, health care and pharmaceutical products. In addition, the Company also has a distribution business for medical devices in collaboration with various brands.

Since 2021, Erajaya has opened over 1,000 new stores, thereby doubling its footprint to 2,000 stores and this has naturally resulted in operating expenses growing faster than revenues hence the share price not performing well in 2023, as profits have declined by -30% YoY in 9M23 versus +20% YoY in revenue growth. ERAA is now close to its 25% retail market share target and thus with the store expansion plan slowing in 2024-2025, store performance reaching its optimal levels, no significant competition, the high operating leverage of this Company is bound to lead to a significant improvement in profits.

Financially, the balance sheet is strong with Net D/E below 1x, the shares are currently trading at 6x trailing PE, and we expect that earnings will grow strongly into 2024, potentially as high as +50%, implying a PE24 of 4x.

Industri Jamu Dan Farmasi Sido Muncul Tbk PT (SIDO IJ) - Market Cap. IDR 15 tn; USD 970 mn

Sido Muncul is a supplementary food & beverage and OTC Pharmaceuticals manufacturer since 1951, well known for its universally used medical product “tolak angin” which most Indonesians consider it as household must have medicine and first choice for non-fetal sickness such as cold, nausea, stomach aches, headaches, feverishness, and dry throat.

Based upon the Company description you would be correct to think that they had benefited greatly during the Covid era and have naturally suffered during 2H22-9M23 with declining sales relative to 2021-2022. The share price of the Company has returned to pre-covid levels, despite the Company having a stronger distribution network, additional products, and a net cash balance sheet. With the recent retail figures suggesting double digit month on month sales growth, we are of the viewpoint that the current valuation is too attractive an opportunity, and view that, short of another pandemic, the Company will return to its double digit compounded growth for the next few years, and should be a major beneficiary of the latest developments in Indonesia.

The shares are currently trading at 15x PE, and offer a 7% dividend yield.

A special few mentions

Fund Weighting: 20%

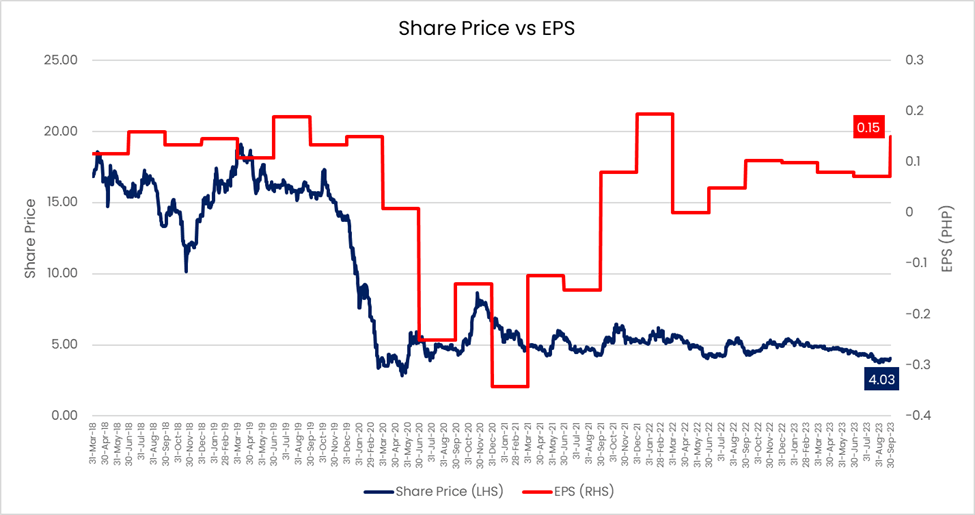

MacroAsia Corporation (MAC PM) Market Cap. PHP 7.8 bn; USD 140 mn

The Philippines appears to be a value investors paradise with several companies still trading far below their 2019 levels, even though earnings have already fully recovered or even surpassed 2019. One such example is MAC.

As a quick background MacroAsia Corporation (MAC) is a leading provider of aviation-related support services in the Philippines. The group mainly operates through three main subsidiaries, in which in-flight catering, ground handling and aircraft maintenance are the main line of businesses. MAC has also ventured into natural resources development, particularly in projects involving water distribution and treatment. This water segment has been growing, adding another revenue pillar for MAC.

In the first 9 months of 2023 their revenues have increased by +79% YoY to PHP 5.7 billion, with its third quarter 2023 revenue achieving an all time high of PHP 2 billion, an all time high, and its net profits have increased +172% YoY to PHP 746 million, with its third quarter 2023 figures matching 2019 levels. As the aviation industry continues to pick up, Macroasia continues to be well-positioned to capture the demand for aircraft maintenance, with its partner Lufthansa.

For 2024 we estimate that profits should increase by another +30-40% indicating that it’s trading at PE of 7x.

S Hotels & Resorts Public Company Limited (SHR TB) Market Cap. THB 9.2 bn; USD 263 mn

SHR has 37 commercially operating hotels, comprising hotels under its management, the Outrigger Hotel, hotels in the CROSSROADS project, the Company's hotels in the United Kingdom, and hotels under joint ventures that have a total of 4,472 rooms. As of 30 September 2023, 36 hotels out of 37 have resumed their normal operation, equivalent to 98.8% of the total number of rooms (4,419 out of a total of 4,472 rooms).

The renovation of several hotels in Thailand, Maldives, Mauritius and Fiji were completed and reopened in the fourth quarter of 2023, to accommodate the peak season.

Financially, SHR’s revenue grew +18% for 9 months 2023 versus last year to THB 7 billion and being continually profitable since 2nd Quarter 2022. The shares are currently trading at P/BV of 0.50x, and we expect to see both revenue and cash profits continue to increase by +20% p.a. until 2025.

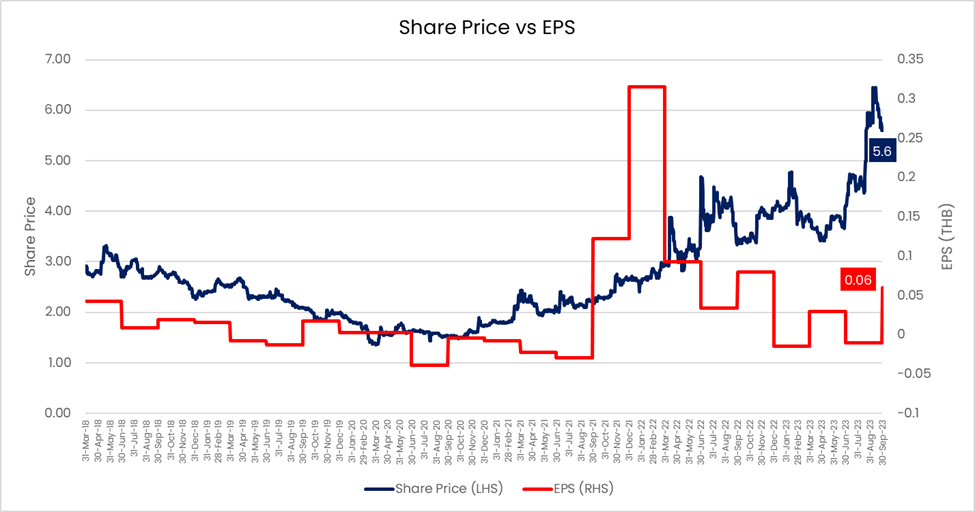

Wattanapat Hospital (WPH TB) Market Cap. THB 3.3 bn; USD 95 mn

We wrote about WPH in our 3Q 2023 Commentary. We consider that this small hospital group is a perfect multibagger play as the Company is expanding capacity with its new hospital in Koh Samui, which increases the number of beds for the overall group by +50%.

It’s been under the radar from most institutions and due to the relative lack of competition in the regions of Thailand that it operates in, will be able to continue to achieve strong margins. The new hospital in Koh Samui just broke even on a cash flow basis 6 months after launch.

In the past two months, they announced a private placement at THB 5.75/share to a domestic institution, a joint-venture with another hospital group to provide services in Southern Thailand, and acquired land adjacent to the new hospital in Koh Samui for future expansion.

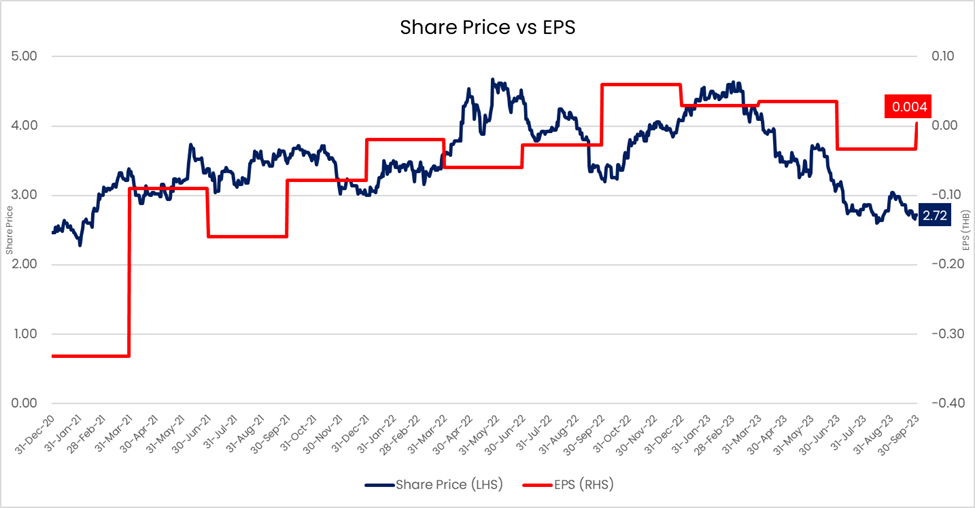

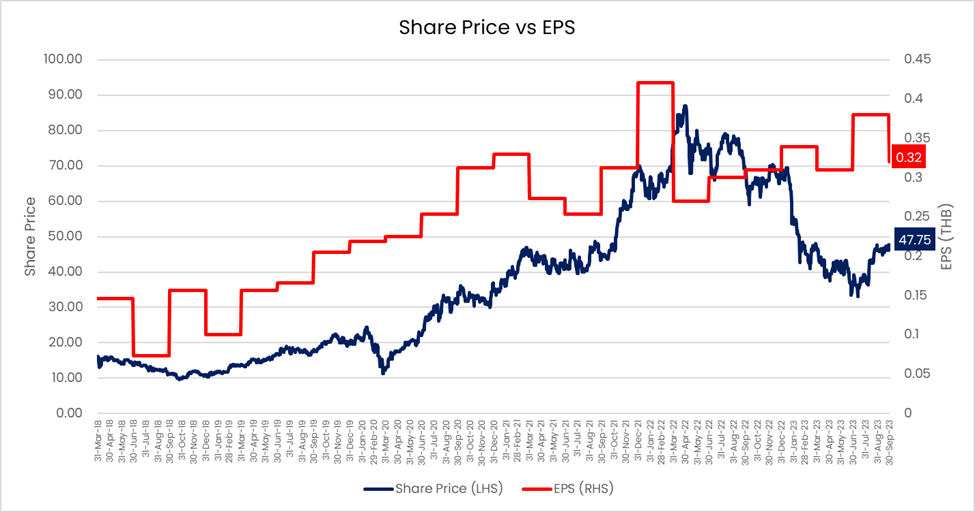

JMT Network Services PCL(JMT TB) Market Cap. THB 39 bn; USD 1.1 bn

Back in 2021, we wrote about the Non bank financials/bad debt collection industry in Thailand

One of the key holdings back then was JMT.

We have re-initiated a high weighting in this name in the past few months as the share price has declined from its covid era highs. As Thailand is transitioning into the latter stages of its credit cycle following the reopening and discontinuation of COVID debt-relief programs, NPL sales have surged. As the leader in the industry, JMT successfully acquired its largest-ever batch of new NPLs worth THB 138 billion in 9M23, and it still hopes to buy more in 4Q23.

In 2022, JMT and Kasikornbank Pcl formed a joint-venture AMC, JK, to effectively buy Kasikornbank’s NPLs. JK has also achieved its NPL acquisition target of THB 100 Billion. As JK has been able to obtain financing from banks, we expect it to fund incremental NPL investments, if any, without the need for a capital injection from JMT.

Financially, the Company’s balance sheet is strong with a Net D/E at 30% and we expect to see its earnings begin to compound by 20% p.a. until 2026 and for its ROE to return to mid-teens.

Disclaimer: Data as of 30 November 2023

Tickers Mentioned

- VEB MK - Velesto Energy Bhd

- PVD VN - PetroVietnam Drilling

- MPM SP - Marco Polo Marine Ltd

- CSE SP - CSE Global Ltd

- DELFI SP - Delfi Ltd

- ARNA IJ - PT Arwana Citramulia Tbk

- ERAA IJ - PT Erajaya Swasembada Tbk

- SIDO IJ - Industri Jamu Dan Farmasi Sido Muncul Tbk PT

- MAC PM - MacroAsia Corporation

- SHR TB - S Hotels & Resorts Public Company Limited

- WPH TB - Wattanapat Hospital

- JMT TB - JMT Network Services Public Company Limited