Musings

The Perfect Thai Play

The rumble of opportunity in the Oil & Gas services sector continues to impress us.

Last year we wrote Riding the Waves - where we said some of the names were paying dividends as high as 10%, we were wrong, it’s 20%.

As of writing, over 40% of our investments are in this space and today we open the kimono on 4 holdings that we held for the past 3-9 months

But black gold services are not the only industry that interests us, we have found the Perfect Thai Play.

When you think of Thailand, what are the first three items that come to mind? Tourism, hospital(ity) and…ladyboys? We explain below.

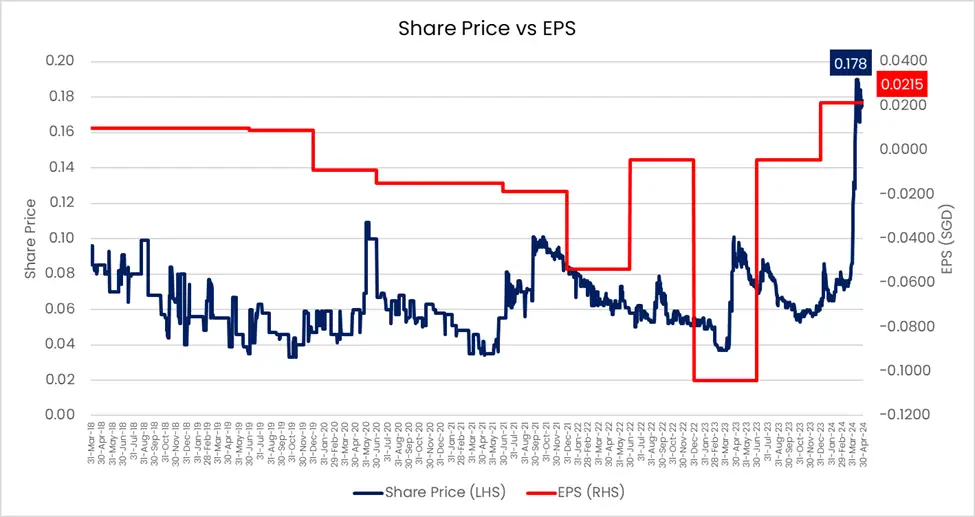

Beng Kuang Marine LTD (BKM SP) Market Cap. SGD 36.5 mn; USD 26.9 mn

BKM SP business is focused on two core business segments of Infrastructure Engineering (“IE”) and Corrosion Prevention (“CP”), marine and offshore energy industries, particularly within the FPSOs and FSOs markets.

In 2021 BKM SP raised new equity at SGD 0.09/share, to restructure the balance sheet, and refocused their business model to be service-centric and asset-light. The core activities are focused on Infrastructure Engineering and Corrosion Prevention which results in a recurring income revenue stream. BKM has exited loss-making business operations in 2022 and 2023, and announced asset disposals of SGD 22.5 mn which monetised land assets and deleveraged the balance sheet.

The impact of these changes combined with the upswing in the O&G capex cycle has resulted in BKM’s 1st Quarter 2024 Profit before tax of SGD 11 mn surpassing the FY23 profit before tax of SGD 10.8 mn, and is a net cash.

Going forward we estimate that BKM’s PE24 is 2x and PE25 is 1.5x with a high potential for 20-30% of 2025 profits to be paid as dividend, implying a potential yield of 13-20%.

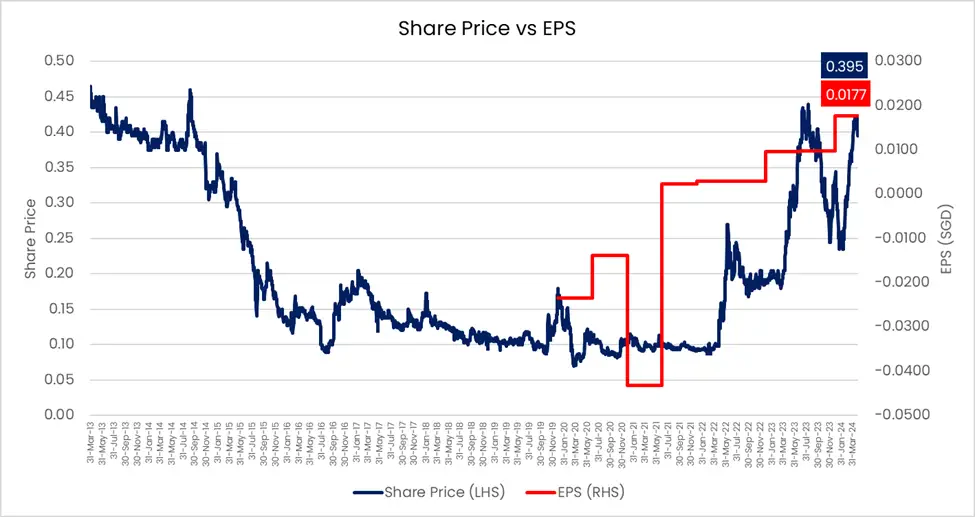

Dyna-Mac Holding Ltd (DMHL SP) Market Cap SGD 413.0 mn, USD 305.2 mn

DMHL SP offers engineering, procurement and construction services to the offshore oil and natural gas, marine construction and other industries. The Company builds topside modules for floating production storage and offloading, semi-submersibles, manifolds, buoys, process piping, and tanks for petrochemical and pharmaceutical plants.

Recently DMHL’s major shareholder, Keppel Corp, sold its entire stake (23.9%) to Hanwha Aerospace and Ocean for SGD100m or SGD0.40/share.

Dyna-mac secured several contracts worth SGD456.m which led to its existing order-book more than doubling to SGD896m with project deliveries stretching to 2026. The main contract involves the construction of process modules and marks the largest-ever contract win in the company’s history.

Going forward DMHL will continue to benefit from the strong FPSO demand, it is net cash, with earnings expected to double by 2026, and is trading at a net cash PE25 of 7x.

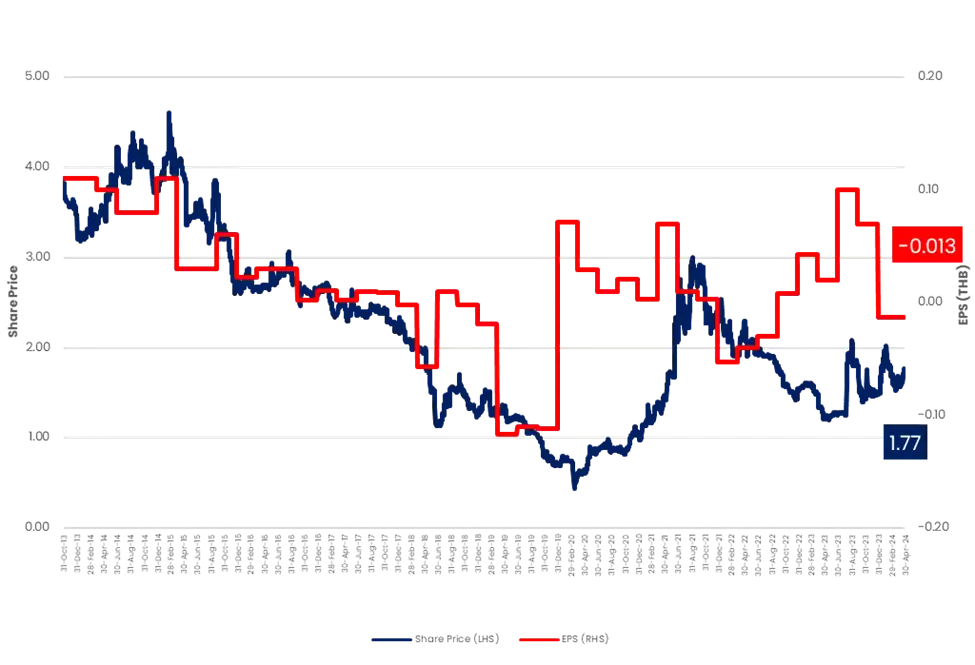

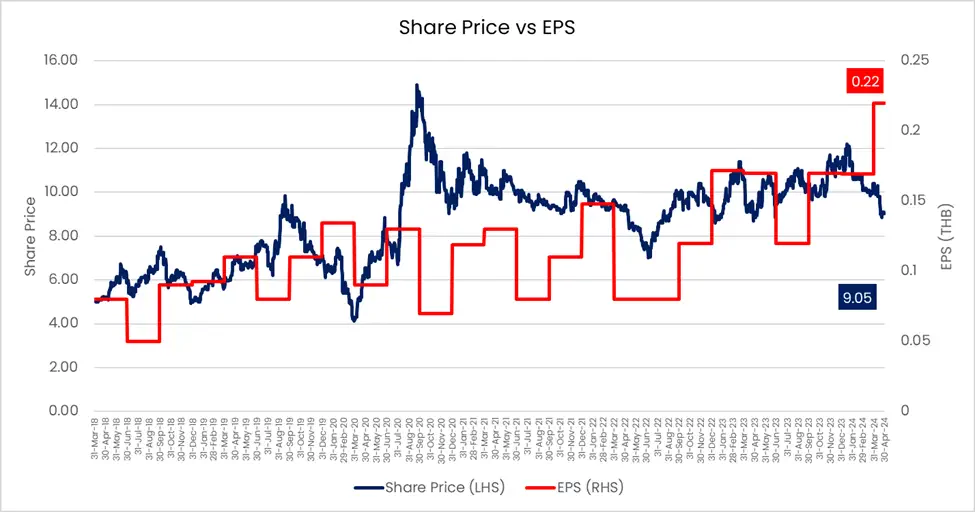

Unimit Engineering PCL (UEC TB) Market Cap THB 983.8 mn, USD 26.6 mn

UEC is a leading engineering and construction company in Thailand. They design, fabricate and construct large pressure vessels, steel structures, non-pressure tanks and several other machinery and mechanical parts for the oil & gas industry.

The company generated a strong financial performance in 2023, its first in a decade. On the books, there is zero debt, land assets valued at book value from three decades ago, and a consistent history of the board paying generous dividends to shareholders.

The shares are currently trading at a Market Capitalisation of THB 983 million, below book value, offers a dividend yield of 12% to 20% over the next three years and is trading at a PE24 net cash of 5x and PE25 of 3x.

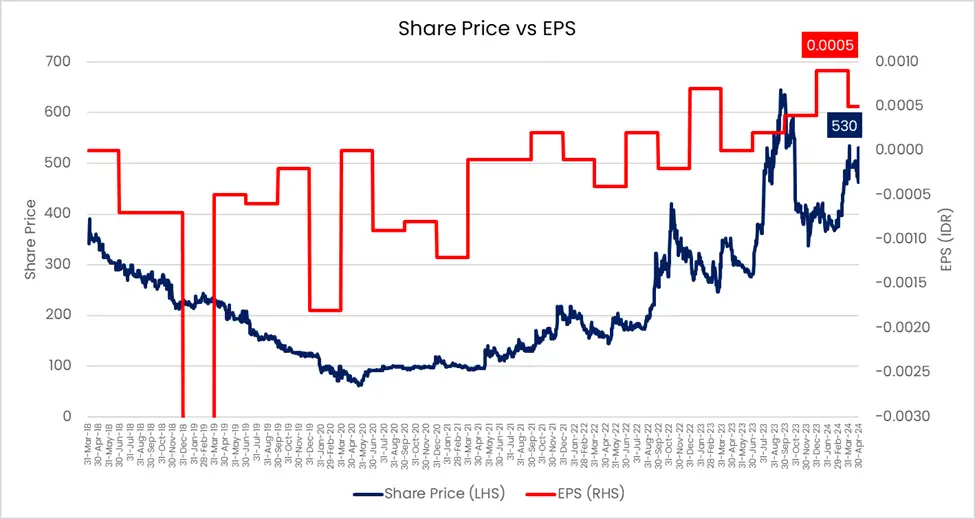

Wintermar Offshore Marine (WINS IJ) Market Cap IDR 2.2 tn, USD 137.0 mn

WINS IJ is a leading Indonesian offshore marine services company specialising in providing comprehensive solutions for the oil and gas industry. The company offers a diverse fleet of vessels, including anchor-handling tug supply vessels (AHTS), platform supply vessels (PSVs), and utility vessels, catering to various offshore needs such as drilling support, towing, and transportation of personnel and equipment.

WINS IJ has a strong track record in managing and operating OSVs in a highly challenging industry and has fully recovered and turned around the fleet composition, with 95% being higher-tiered vessels such as Platform Supply Vessel (PSV) and Anchor Handling Tug Supply (AHTS). This is impressive given that in 2013, 95% of the fleet was low-tier (such as tug boats).

The company is benefiting from the rapid increase in vessel rates, in 12 months they have increased from USD 8,000/day to USD 20,000/day and is trading at PE25 of 4x and PE26 of 3x.

A special few mentions

Union Auction PCL(AUCT TB) Market Cap. THB 5.0 bn; USD 136.2 mn

AUCT TB is the leading auction company in Thailand. The company focuses on auctioning automobiles, property and goods. In practice 90% of their business is receiving a fee per automotive (cars and motorcycles) sold through its multiple auction houses throughout the country.

Thanks to the incredibly weak leadership that Thailand had for the past decade, combined with Covid era mess, combined with continued weak leadership, this perfect storm has resulted in a weak economic environment where NPLs are increasing, banks are rushing to repossess automotives and these vehicles are being auctioned through AUCT TB.

In 2023, the company’s earnings grew by +50%, in the first quarter of 2024, its earnings grew by +25%, the outlook for the company is incredibly positive with a backlog of vehicles that may take 2 to 3 years to be sold into the market - assuming no new repossession.

Currently the company generates a Return on Equity of 55%, cash flows of THB 800 mn p.a. (20% cash flow yield), profits of THB 400-500 mn p.a (10x PE), Net profit margins of 35%, and earnings likely to continue growing by +20% p.a. until 2027, without any financial debt on its balance sheet.

Master Style PCL(MASTER TB) Market Cap. THB 18.9 bn; USD 512.3 mn

MASTER is the leading cosmetic surgery hospital in Thailand. It’s been operating for 10 years under the Masterpiece brand and is benefiting from the rising trend in cosmetic surgery capturing international customer market share from the historical leaders, Korea.

The Company has two service buildings with 17 operation rooms and covers surgical services, non-surgical procedures, with a strong expertise in nose rhinoplasty, eyebrow lift, chin lift, breast surgery, laser liposuction and body transformation, eyelid surgery, and facelift and reconstruction.

The company’s business expansion is both organic via room expansion and through M&A where they acquire equity stakes, specifically M&P deals, as it sees opportunities in the highly fragmented cosmetic market. Since its IPO in 2023, MASTER has announced 15 deals, 84% in the aesthetic segment at 11% in media & advertising companies. Which have driven their earnings ahead of market expectations.

For 2024-2027 we expected to see the company compound profit growth at 30% p.a.

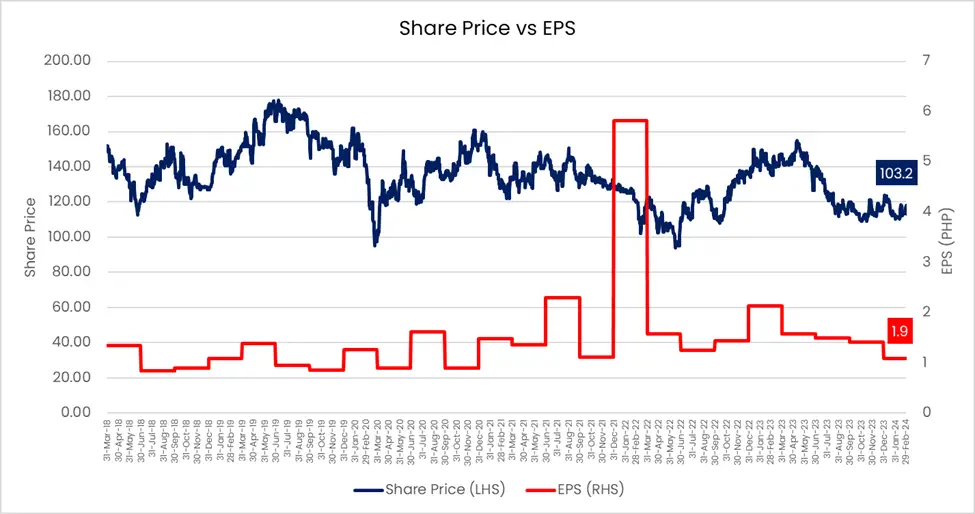

Universal Robina Corp(URC PM) Market Cap. PHP 226.4 bn; USD 3.9 bn

URC PM is one of the largest branded consumer food and beverage product companies in the Philippines. URC has built three strong regional brands over the years— Jack 'n Jill for snack foods, C2 Cool and Clean for ready-to-drink tea, and Great Taste for coffee. These brands are becoming popular across the ASEAN region.

URC’s shares are trading at the 2020 covid lows which is a wonderful entry point for a company whose earnings are 25% higher than 2019, is outperforming market expectations the 1st Quarter of 2024 revenues improved +7% YoY, and operating profit increased by +16% YoY, the company implemented a share buyback program and raw material prices have declined 30-40% from their peaks.

The outlook is positive as the company is benefitting from pricing and cost saving initiations, reinvesting into brands and will be growing revenues by high single digits. Currently the shares are trading at 15x PE.

Tickers Mentioned

- AUCT TB - Union Auction PCL

- BKM SP - Beng Kuang Marine Ltd

- DMHL SP - Dyna-Mac Holdings Ltd

- UEC TB - Unimit Engineering PCL

- MASTER TB - Master Style PCL

- URC PM - Universal Robina Corp

- WINS IJ - Wintermar Offshore Marine